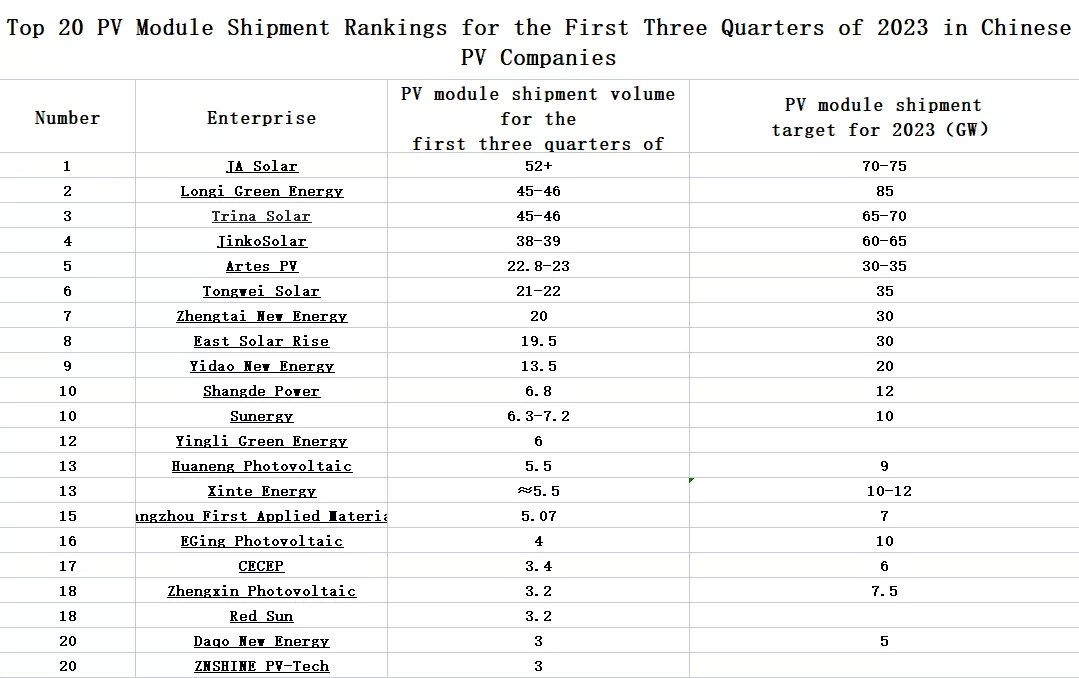

Top 20 PV Module Shipment Rankings for the First Three Quarters of 2023 Released!

Top 20 PV Module Shipment Rankings for the First Three Quarters of 2023 Released

Entering the third quarter, the prices in the PV industry chain rebounded temporarily but returned to a downward trend due to inventory and supply-demand dynamics. In terms of module bidding, leading brands (Top 4) and emerging brands (Top 5-9) continued to dominate, frequently winning bids. Companies such as JinkoSolar, Yingli, Risen, GCL, and GS-Solar also achieved notable results. In terms of prices, the lowest bidding prices for p-type and n-type modules were 0.9933 RMB/W and 1.08 RMB/W, respectively. Some companies even quoted the same price for n-type and p-type modules in bidding, which brought excitement to many PV industry professionals.

According to data released by the Ministry of Industry and Information Technology, from January to August this year, China's polycrystalline silicon production exceeded 839,500 tons, silicon wafer production exceeded 352.3 GW, cell production exceeded 309.2 GW, and module production exceeded 280.7 GW, all showing significant year-on-year growth. In terms of installations, data from the National Energy Administration shows that China's new solar power installations reached 128.94 GW from January to September. Although the monthly new installations in August and September showed a slight decline, they have laid a solid foundation for the overall market growth throughout the year. It is expected that China's new solar power installations will reach 150-160 GW (AC) this year, and the global new solar power installations are expected to reach 450 GW (DC), setting a new record.

After two weeks of communication, research, and verification by Solarbe.com and Solarbe Consulting, the PV module shipment rankings of Chinese PV companies that we have obtained are as follows:

█ The rankings of leading and emerging brands remain relatively stable, with only slight changes in positions.

With its advantage in n-type industry chain layout and brand recognition in overseas markets, JA Solar dominated the competition with module shipments exceeding 52 GW in the first three quarters, surpassing its competitors. Longi, Tongwei, and JA Solar's module shipments in the first three quarters were also close to the full-year level of the previous year, and they are expected to achieve their annual targets without much pressure.

Among the emerging brands, Tongwei is undoubtedly the strongest challenger, with a single-quarter module shipment of nearly 11 GW and a total shipment of 21-22 GW in the first three quarters, securing the 6th position. Zhejiang Jinko Solar also demonstrated stronger competitiveness, actively participating in bidding and supply activities, seizing every opportunity, and achieving a module shipment of approximately 20 GW in the first three quarters.

█ Orders are increasingly concentrated among leading and emerging brands, and shipment targets have been adjusted accordingly.

Profits in the industry mainly flowed into the silicon wafer and cell segments in the third quarter. Enterprises that have already established a complete industry chain usually enjoy certain cost advantages. Additionally, we have noticed that some leading and emerging brands actively bid at lower prices and supply promptly after winning bids, thereby gaining a larger market share.

For example, in the first three quarters, the total module shipments of the top four manufacturers reached approximately 180 GW, accounting for over 50% of the market. The top nine brands achieved a combined module shipment of over 275 GW, exceeding 80% of the global market demand, leaving relatively limited space for other companies.

Compared to the previous report, it can be observed that some leading and emerging brands have raised their annual shipment targets, while some second and third-tier brands have moderately adjusted their targets based on the evaluation of completion rates. It is expected that the threshold for the Top 10 rankings may reach 10 GW, and the threshold for the Top 20 rankings may exceed 4 GW.

█ N-type technology remains the mainstream direction in the industry.

Regarding future technological routes, most companies have chosen n-type technology, with TOPCon clearly surpassing HJT. Based on the data provided by module companies, the proportion of n-type module shipments in the first three quarters was high or close to 40% for companies like JA Solar, Zhejiang Jinko Solar, Aikosolar, Shangde, and CSUN. However, there are also a few companies with n-type module proportions around 10%.

It is worth noting that almost all newly built capacities of enterprises are targeting high-efficiency n-type cells, and some companies have already set their development targets for n-type technology in 2024. Zhejiang Jinko Solar stated that 90% of their module shipments next year will be n-type modules. Aikosolar, GCL, and Sunshine Energy have also increased their targets for the proportion of n-type module shipments to 75%, 70%, and 60%, respectively. JA Solar has not yet provided a specific target for n-type module shipments in 2024, but their n-type module proportion this year is no less than 60%, indicating it will be higher next year.

Solar Cell IV Test before Tabbing

Market Research Industry Learning

Non Destructive Cutting Machine Thermal Laser Separation Cutting Machine