TOPCon comprehensive analysis

I. Overview

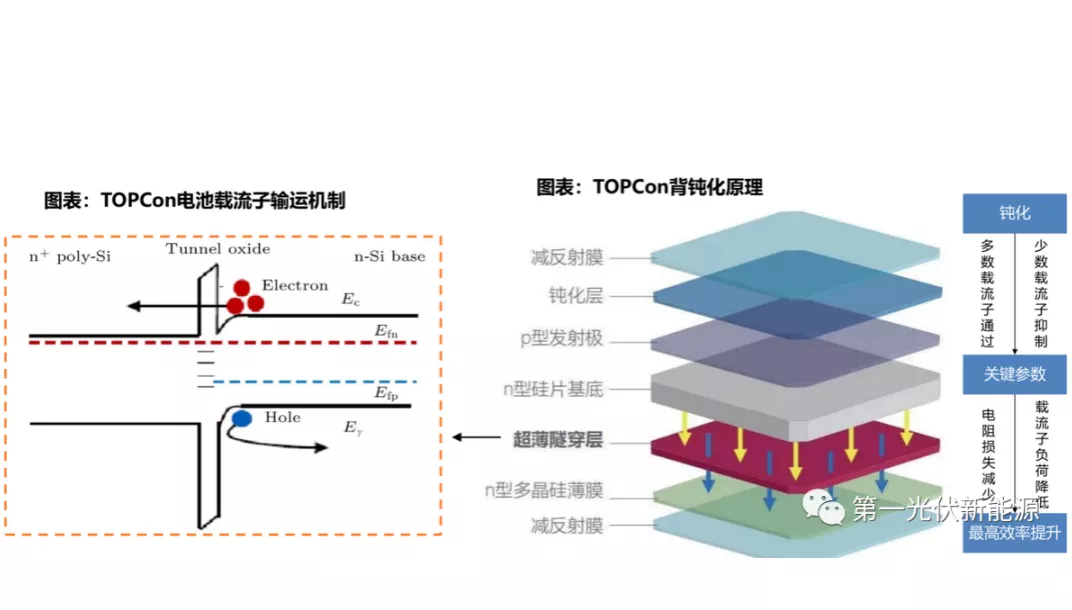

TOPCON solar cells are solar cells that use an ultra-thin tunneled oxide layer as a passivation layer structure.

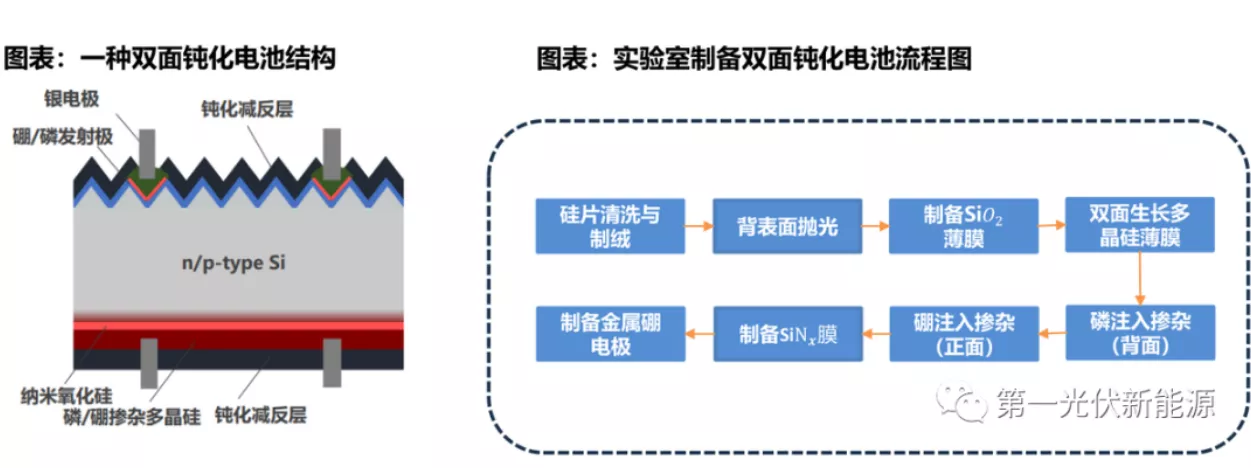

TOPCON battery substrate is mainly N-type silicon substrate, and a layer of ultra-thin silicon oxide tunneling oxide layer (1-1.5nm) is prepared by wet process on the back of the battery and a doped polysilicon thin layer with a thickness of about 20nm is deposited, which together form a passivation contact structure, and then annealed and recrystallized to enhance the passivation effect.

The back passivation contact structure of TOPCON provides good surface passivation for the back of the silicon wafer, and the ultra-thin oxide layer can tunnel the polyon (electron) into the polysilicon layer while blocking the oligoon (hole) recombination, and then the polytron is collected by the metal in the lateral transmission of the polysilicon layer, thereby greatly reducing the metal contact composite current and improving the open circuit voltage and short circuit current of the battery.

Second, technical characteristics

1. Efficiency

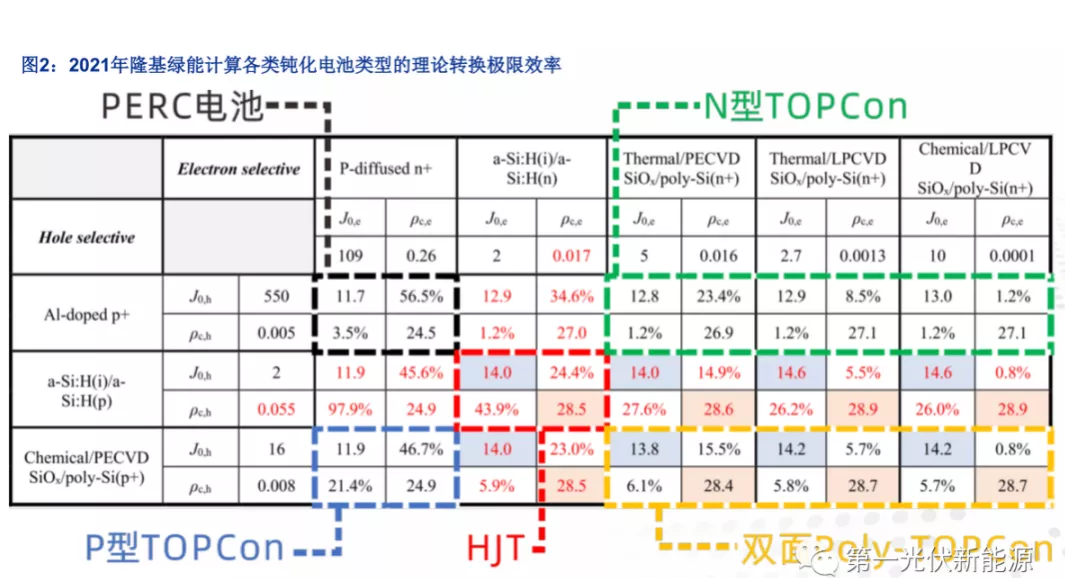

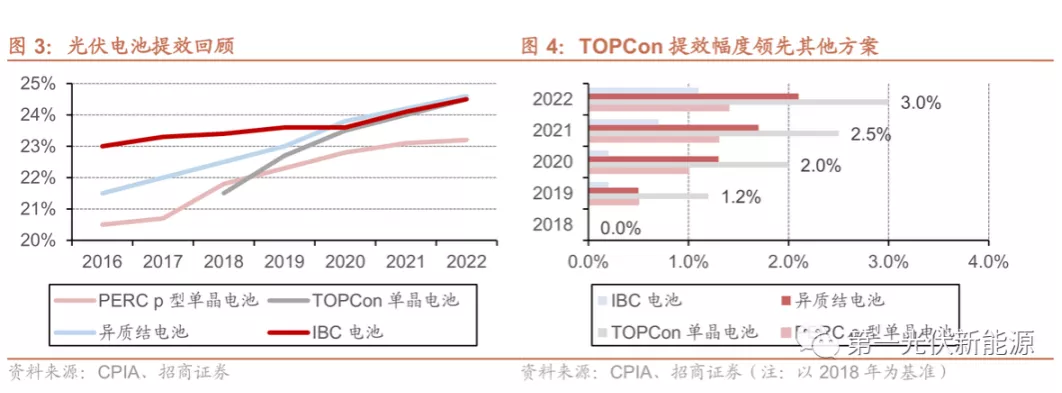

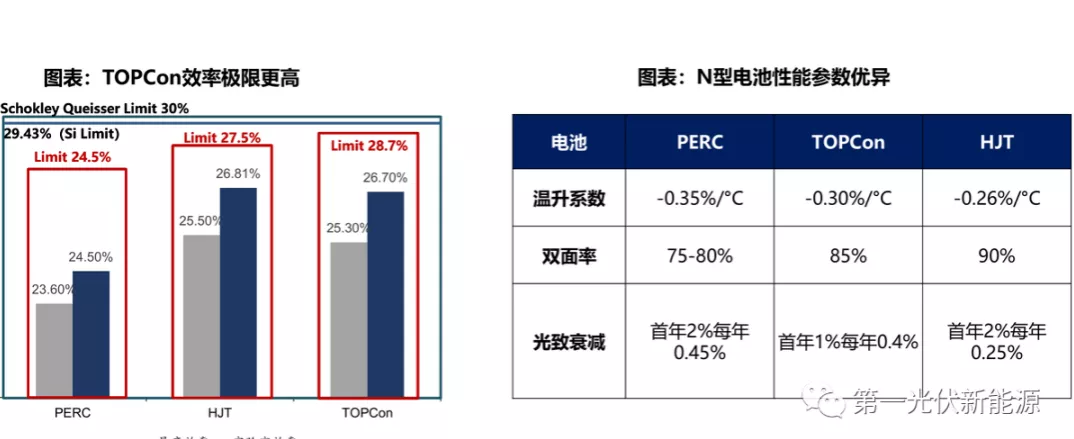

The theoretical limit efficiency of TOPCON is 28.7%, which is higher than 24.5% of PERC and 29.2% of HJT, which is close to the efficiency limit of 29.43% for crystalline silicon photovoltaic cells.

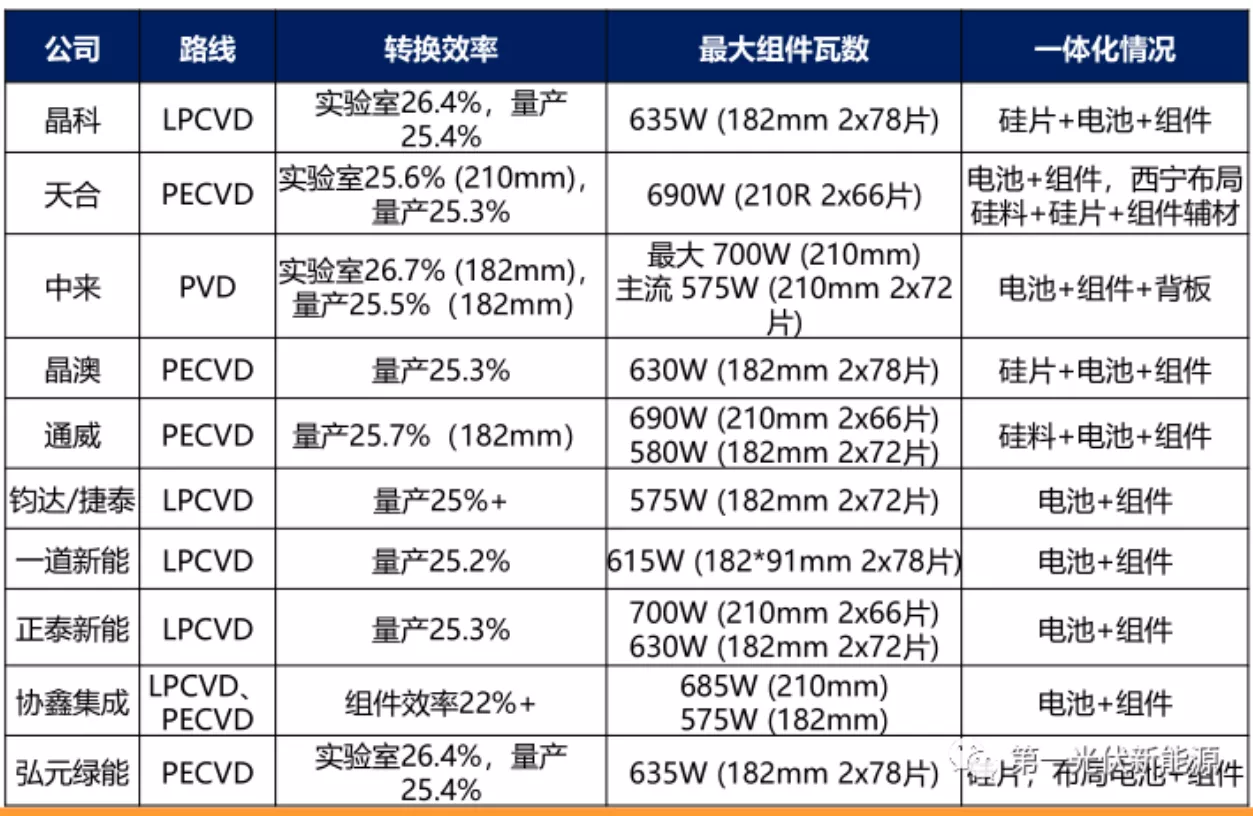

At present, the highest records of TOPCON laboratory and mass production efficiency are 26.7% for Zhonglai and 25.7% for Tongwei, respectively.

Note: This figure does not include the peak statistics of 29.2% based on the highest theoretical limit of HJT achieved in May this year

It can be said that the selective transmission of carriers is an inevitable choice for the high efficiency of solar cells, and the contact region composite current density (Joc) and contact resistance (ρc) indicators can evaluate the open circuit voltage and fill factor of the battery and determine the conversion efficiency.

The reason for the improvement of TOPCON efficiency is that the N-type silicon-based substrate is adopted, and the passivation structure on the back side can make the few birthrates have a longer life cycle, reduce the recombination of carriers, and reduce frontal occlusion with SMBB.

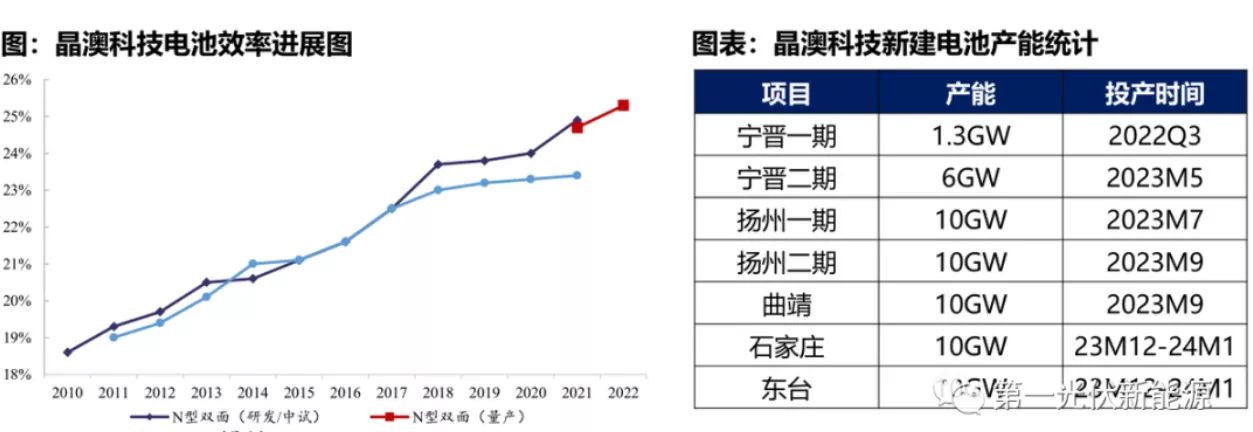

At the end of 2022, JinkoSolar's monocrystalline bifacial N-type TOPCON cells achieved a conversion efficiency of 26.4%. In April this year, Jolywood TOPCON increased this efficiency value to 26.7%, and the efficiency improvement of TOPCON batteries continues.

2. Performance

TOPCON batteries have high bilaterality, low temperature rise coefficient and attenuation rate. At present, the TOPCON bifacial rate is about 85%, the temperature rise coefficient is as low as -0.3%/°C, and the power generation per watt of the battery is improved. At the same time, the decay rate of TOPCON in the first year is 1%, which is 50% of the decay rate of PERC in the first year, and the decay rate of TOPCON is about 0.4% per year after that.

3. Compatibility

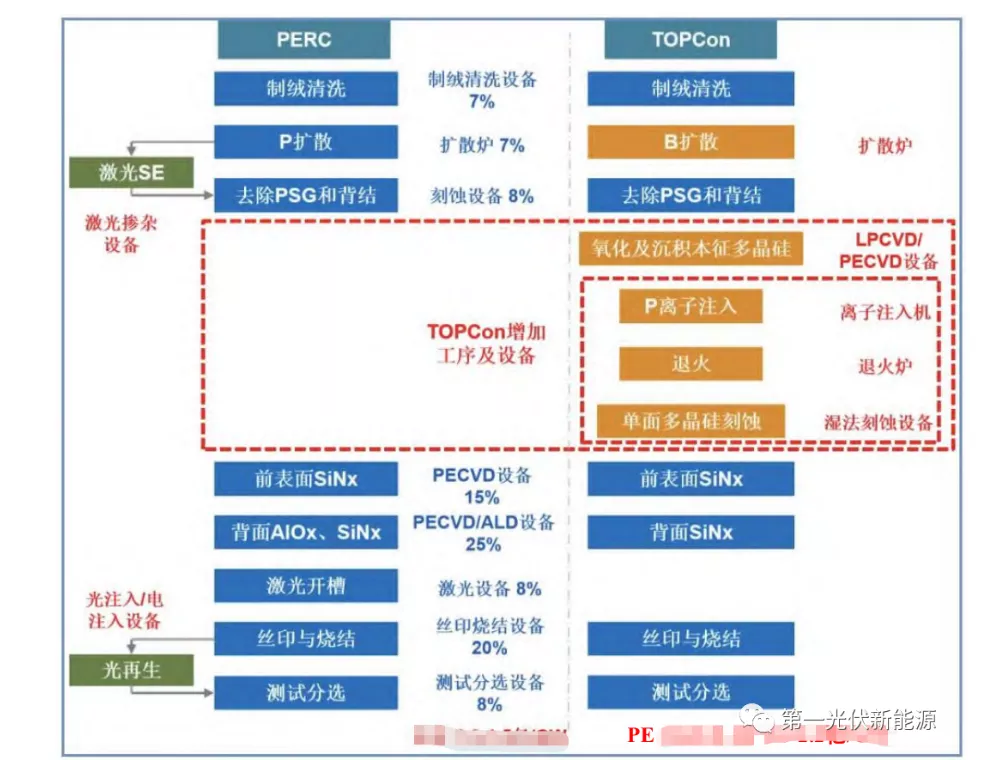

Compared with PERC, TOPCON adds boron diffusion, tunneling oxide, polysilicon doping deposition and cleaning, eliminating the laser grooving process. Most TOPCON production lines can be upgraded based on PERC production lines, which greatly reduces equipment investment costs and is expected to be a better choice route for the future transformation of existing PERC production capacity.

4. Equipment transformation

TOPCon cells can be upgraded on the basis of PERC production lines, with an initial investment of about 1.5-170 million yuan per GW, and an upgrade cost of 40-50 million yuan per GW based on PERC production lines.

Compared with P-type batteries, TOPCon changes phosphorus diffusion to boron diffusion, increases the preparation of tunneling layer and poly layer, and eliminates the laser grooving step.

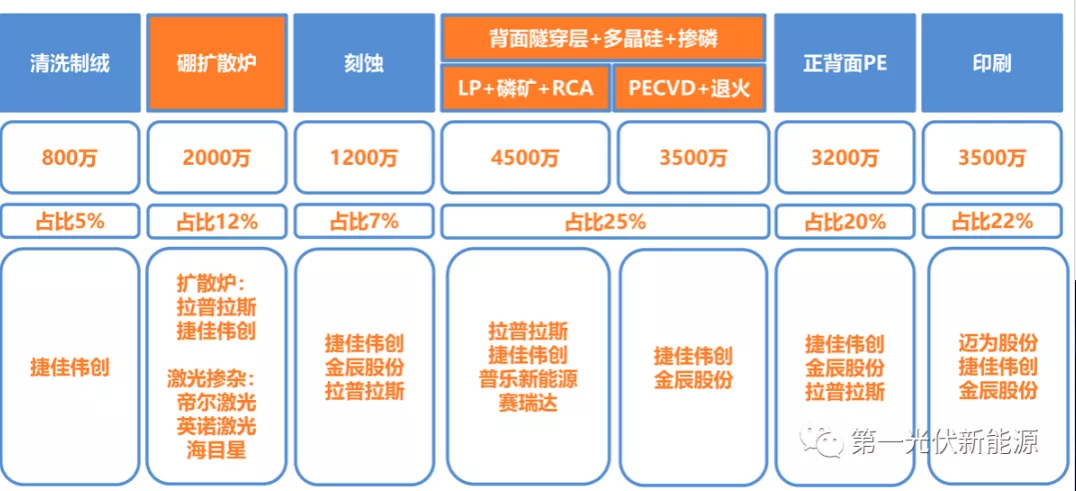

In the initial equipment investment, the cleaning and texturing equipment was 8 million yuan, accounting for about 5%; The cost of boron diffusion furnace is about 20 million, accounting for about 12%; The cost of etching equipment was 12 million, accounting for about 7%; Backside tunneling oxidation and polysilicon doping related equipment about 45 million (LPCVD) and 35 million (PECVD); The cost of double-sided anti-reflection film equipment is about 32 million, accounting for 20%; The cost of screen printing equipment is about 35 million, accounting for 22%. In addition, the PERC production capacity after 2020 can be retrofitted and upgraded under the condition of reserved units, and the upgrade cost is about 40-50 million yuan/GW, mainly the cost of oxidation tunneling and phosphorus doping equipment.

Third, the core process

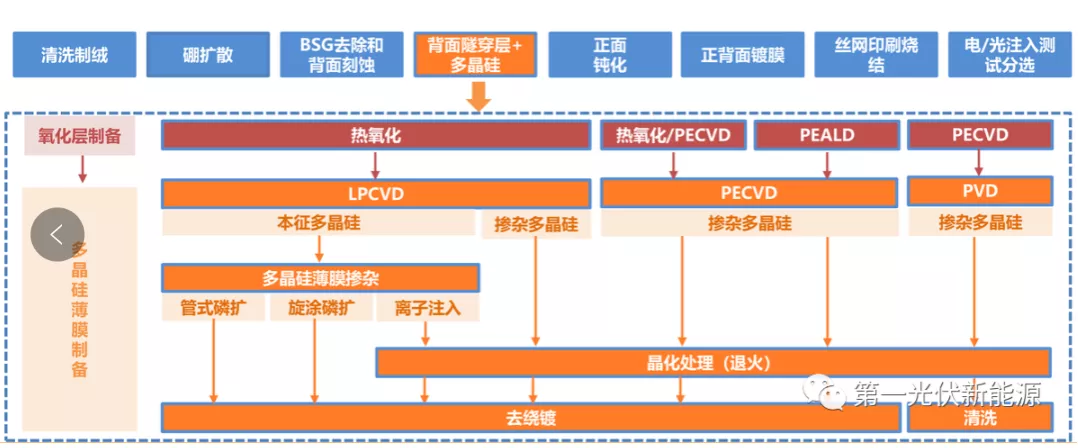

As mentioned above, the preparation process of TOPCon battery includes cleaning and texturing, front boron diffusion, BSG removal and back etching, oxide layer passivation contact preparation, front alumina deposition, front and back silicon nitride deposition, screen printing, sintering and test sorting, about 12 steps, of which passivation layer thin film deposition, that is, CVD, is the core process link.

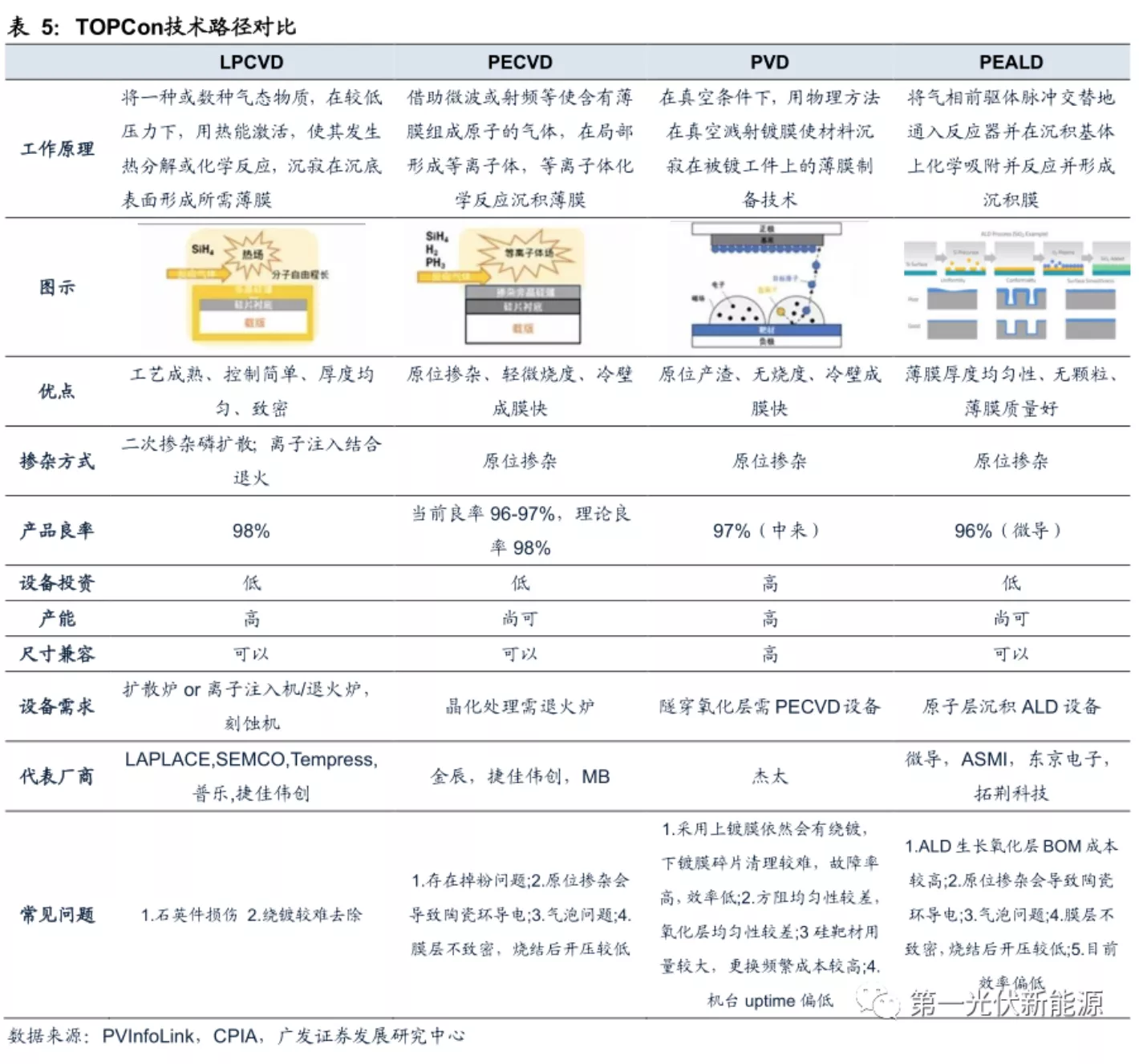

The TOPCon process can be divided into four types: LPCVD, PECVD, PEALD+PECVD, PCD POLY Si, according to the different passivation methods.

LPCVD is low-pressure vapor deposition, the principle is that one or several gaseous substances are thermally activated at a lower pressure to cause thermal decomposition reaction, and then deposited on the surface of the substrate to form the required film;

PECVD is plasma-enhanced vapor deposition, which uses microwaves or radio frequencies to form a plasma locally for gases containing thin film atoms, and deposits the required thin film on the substrate;

PEALD+PECVD is plasma-enhanced atomic layer deposition, which combines the advantages of ALD and plasma-assisted deposition;

PVD is physical vapor deposition, in which a material is deposited on the plated workpiece by a physical method (vacuum sputter coating) under vacuum conditions.

At present, POPAID belongs to PVD deposition silica and polysilicon film technology, according to which this process solves the serious problem of mass production and plating of traditional routes.

LPCVD, PECVD, PEALD+PECVD, PVD polySi four ways have their own advantages and disadvantages, the current industry with LP as the mainstream:

1) LPCVD: It has great advantages in efficiency, yield and capacity, the current GW-level mass production efficiency is 24.9%, the laboratory efficiency is 25.7%, the yield is 97%, the film formation rate is about 5-8nm/min, single plug 4300pcs, double plug 8000pcs, but there are problems such as short quartz life, large consumables, slow deposition rate and serious winding plating, and there is still room for improvement;

2) PECVD: the deposition rate is as high as 16nm/min, the winding plating is slightly within 2mm, easy to dope in situ, the equipment input cost is lower than the LP route, and it is expected to be applied on a large scale after the verification of future yield and efficiency data. Based on the PE route, the three-in-one PE-poly equipment launched by Jiejia Weichuang has attracted much attention from the market;

3) Other routes: PEALD+PECVD method, the use of PEALD to deposit silicon oxide can solve the original inhomogeneity problem; The PVD method has fast film forming speed, no winding plating, which is conducive to thinning and multi-functional upgrade, but the equipment price is high and the uniformity of square resistance is poor.

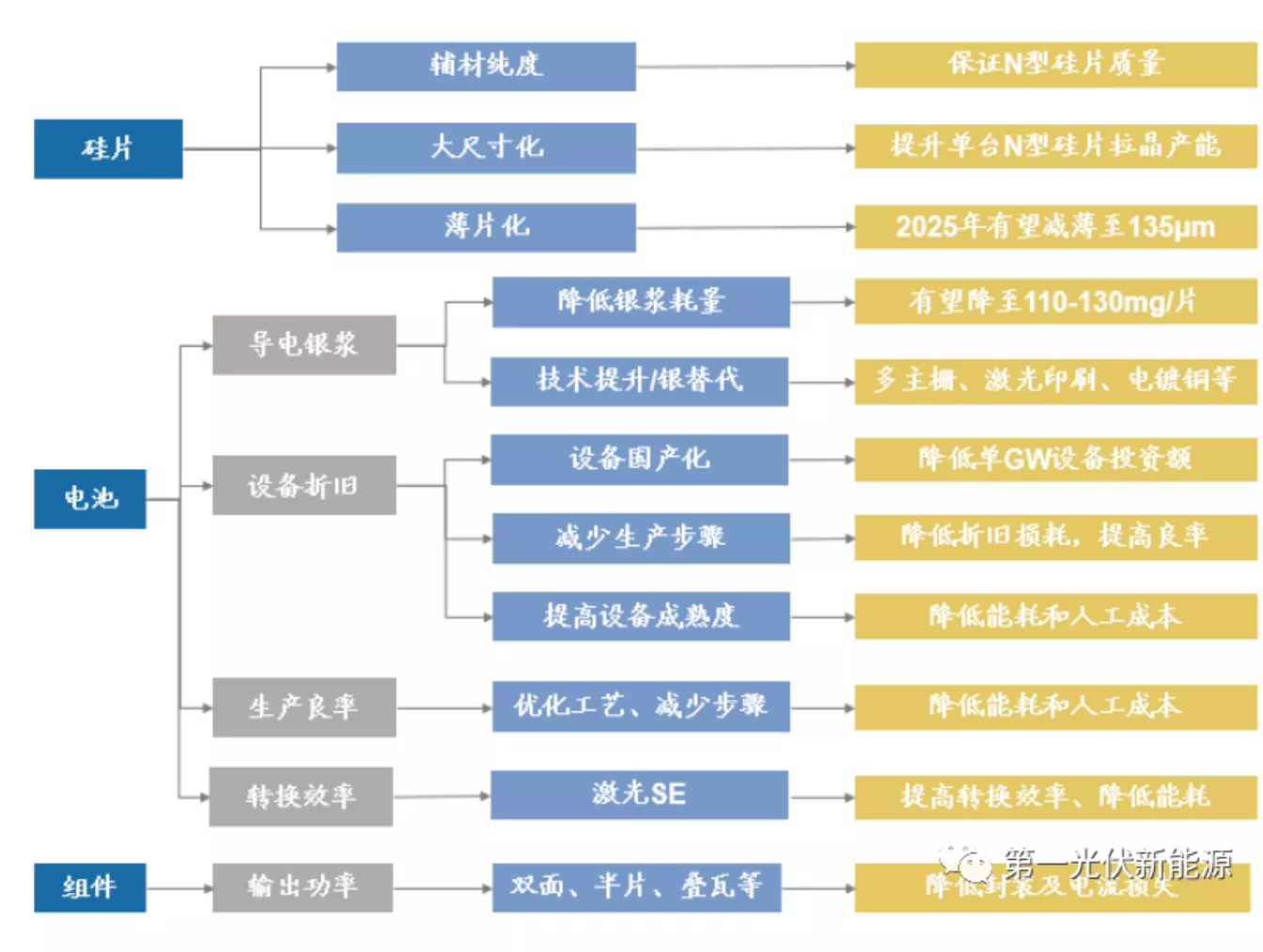

Fourth, reduce costs and increase efficiency

(1) Cost reduction

At present, the cost integration of TOPCon batteries is about 0.04 yuan/W higher than that of PERC, and the outsourcing link is about 0.01 yuan/W higher.

1. Thinning of silicon wafers

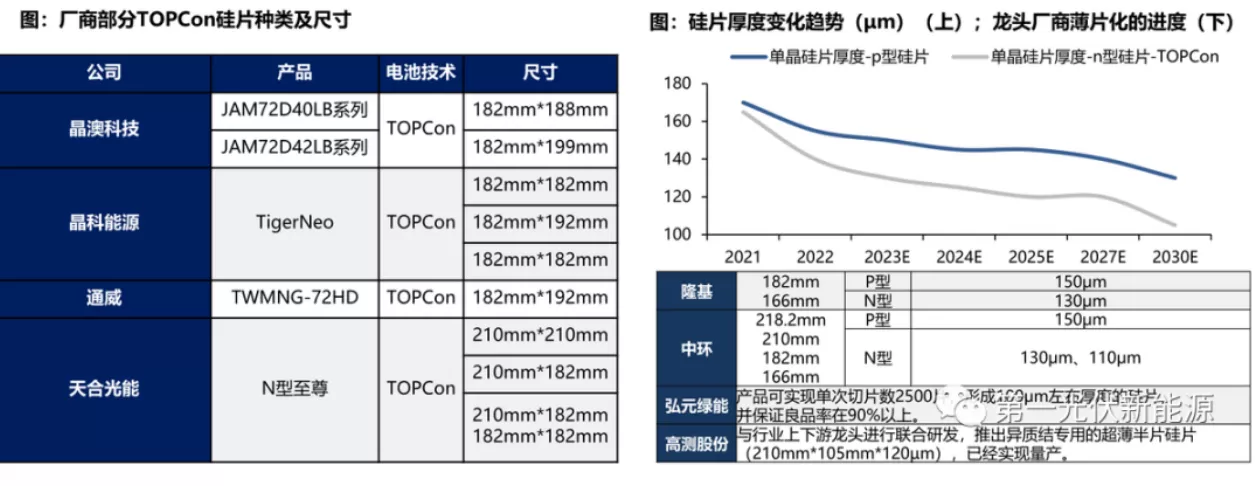

N-type silicon wafers are made by doping phosphorus elements, because phosphorus atoms and silicon are poorly compatible, so the purity and production process control of silicon and auxiliary materials are higher requirements, the cost is higher, and there is a certain premium compared to P-type silicon wafers. However, with the large-scale production of N-type silicon wafers and technological progress, the process of superimposed thinning is accelerating, and the premium of N-type silicon wafers is expected to gradually shrink.

According to TCL Central's wafer quotation on 5/11/23, there is a 1.8% premium over P-type 182-size N-type silicon wafers, which has been significantly lower than the 8.1% premium in June 2022.

According to CPIA, the average thickness of TOPCon/PERC silicon wafers in 2022 is 140μm and 155μm, respectively. At present, the thickness of the industry's mainstream TOPCon silicon wafer is 130μm, which is 20μm lower than the mainstream PERC 150μm.

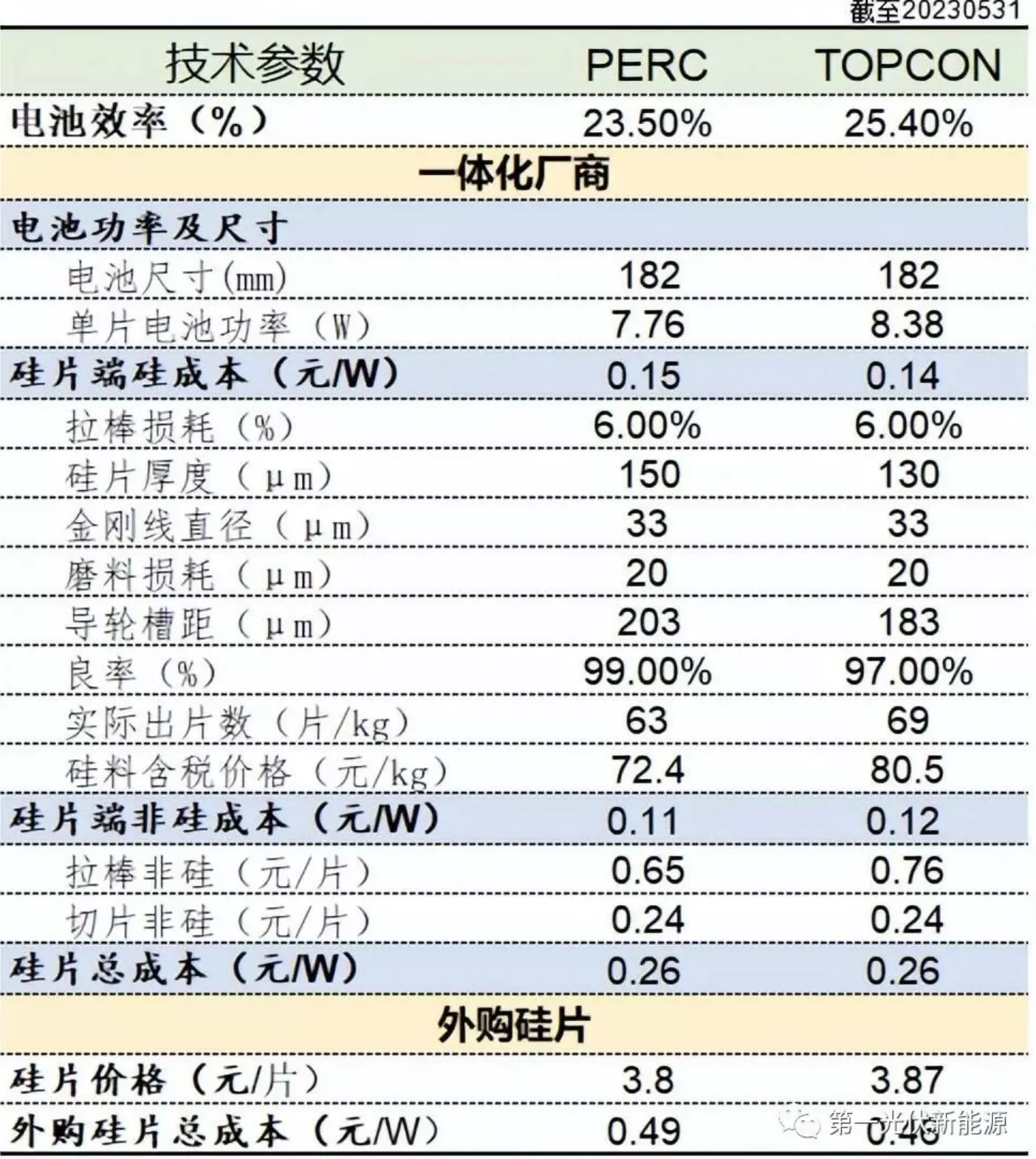

According to the latest N/P polysilicon price of 80.5/72.4 yuan/kg on June 14, the results show that the cost of TOPCon silicon is about 0.14 yuan/W, which is 1 point/W lower than PERC. In addition, purchased silicon wafers cost about 60-70% more at the wafer end than integrated manufacturers, as shown in the table below.

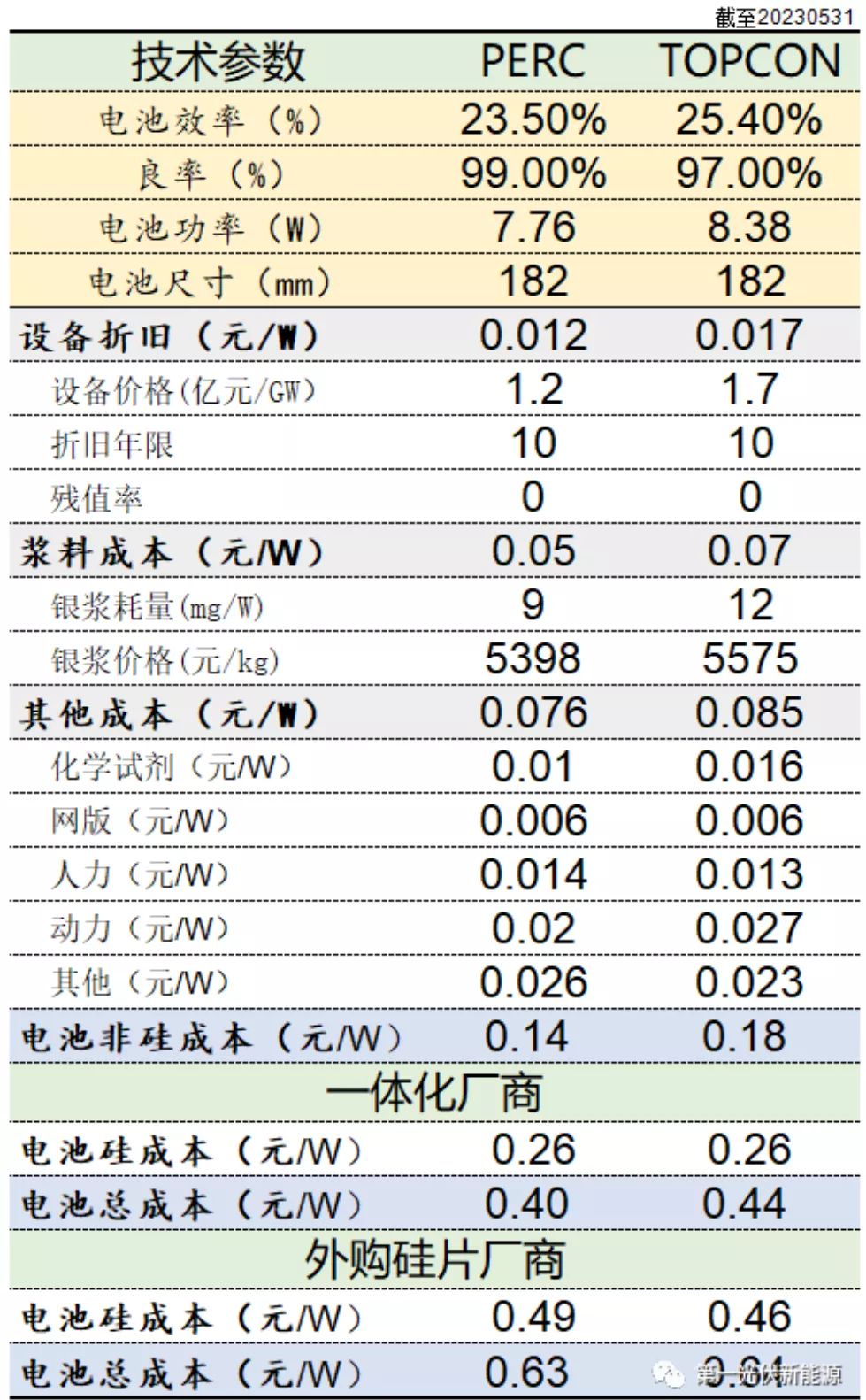

2. Non-silicon cost

At present, the non-silicon cost of TOPCon batteries is about 4 points/W higher than that of PERC, and the overall total cost is about 3-4 points/W higher.

1) On the equipment side, TOPCon is about 50 million yuan higher than the investment cost per GW of PERC, and the depreciation cost per watt increases by 1 cent/W;

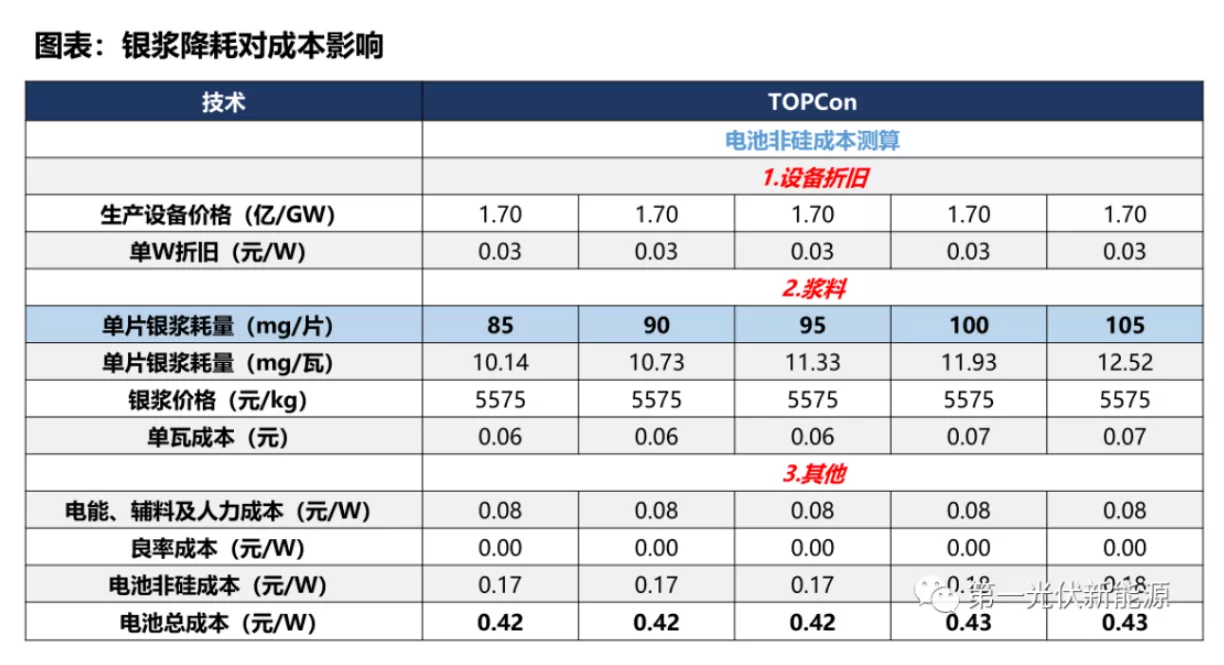

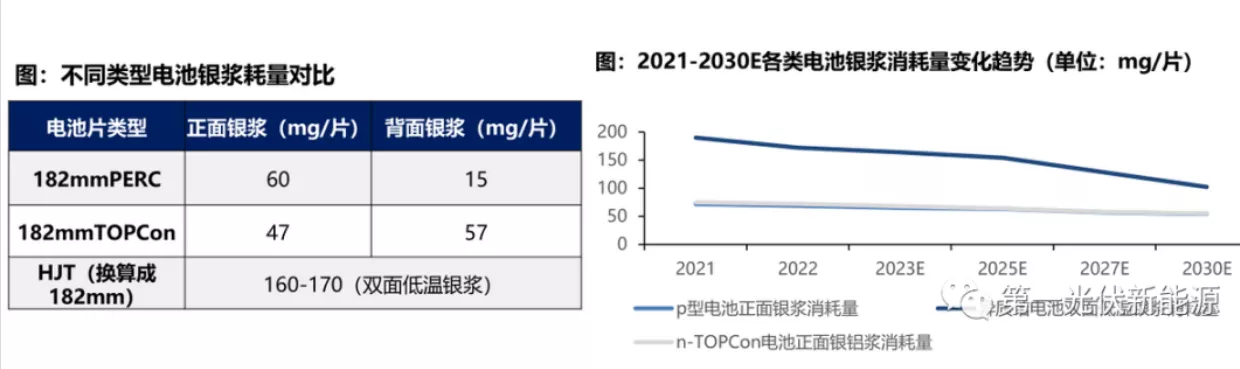

2) In terms of silver paste, TOPCon silver consumption (positive silver + back silver) is about 12-13mg/W (105mg/piece), which is 2 points/W higher than PERC silver consumption (positive silver + back silver) 9-10mg/W cost;

3) In terms of other costs, the TOPCon route process increases, which increases the cost of electric energy auxiliary materials and labor by 1 point/W compared with PERC;

4) In terms of yield, the yield of TOPCon is 2pct lower than that of PERC, resulting in a cost of about 0.15 points/W higher than that of P-type.

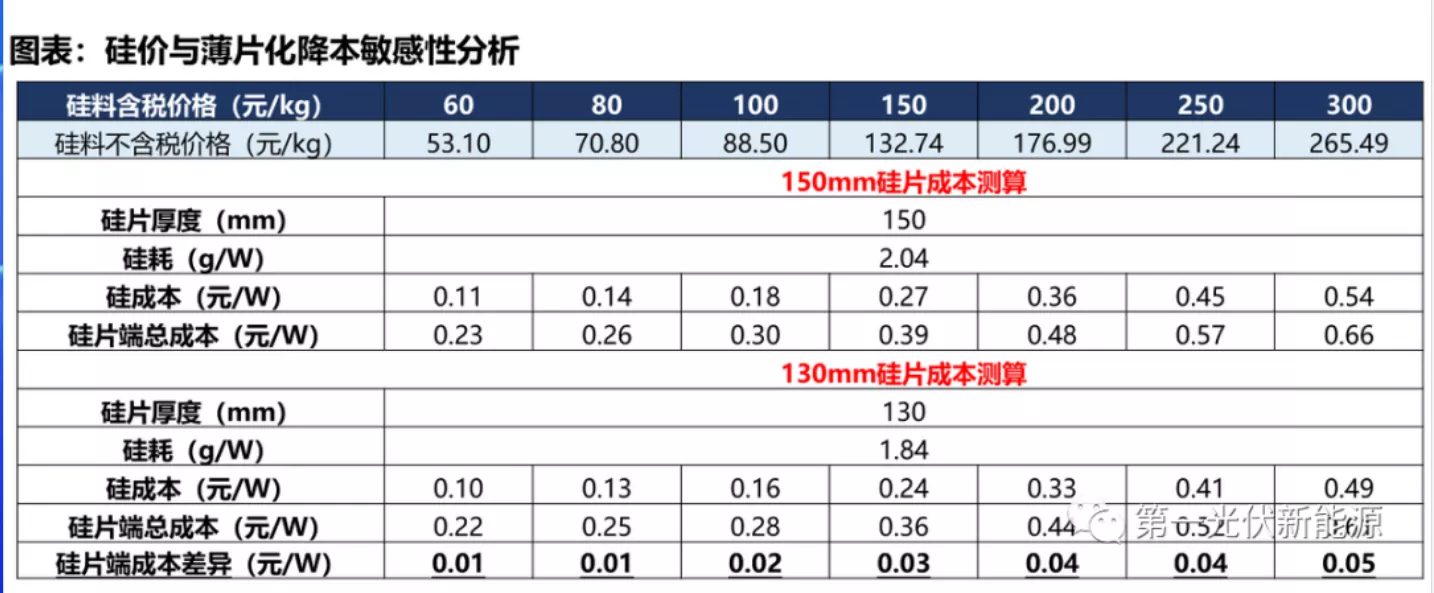

3. Sensitivity analysis

At present, polysilicon production capacity continues to increase and reduce prices, and polysilicon prices have fallen rapidly from a high of 300,000 / ton to 80,000 / ton, and the cost reduction caused by thinning has narrowed. According to Soochow Securities, the price of silicon will drop from 300 yuan/kg to 60 yuan/kg, and the cost difference between 150mm and 130mm silicon wafers will decrease from 0.05 yuan/W to 0.01 yuan/W.

4. Silver splitting

Among the non-silicon costs, silver paste costs account for the highest proportion, accounting for about 16% of the total battery cost. TOPCON and PERC are the same, both use high-temperature silver paste, and currently mainly reduce the consumption of positive silver through multi-main gate technology and reducing the width of the fine grid.

Assuming that the price of silver paste excluding tax is 5,575 yuan/kg, and the double-sided silver paste consumption of 105mg corresponds to a cost per watt of 0.07 yuan, with the future development of technology, multi-main gate + high-precision string welding is expected to reduce the consumption of silver paste to 90mg/piece, corresponding to a cost of 0.06 yuan/W and a decrease of 0.01 yuan per watt.

(2) Profits

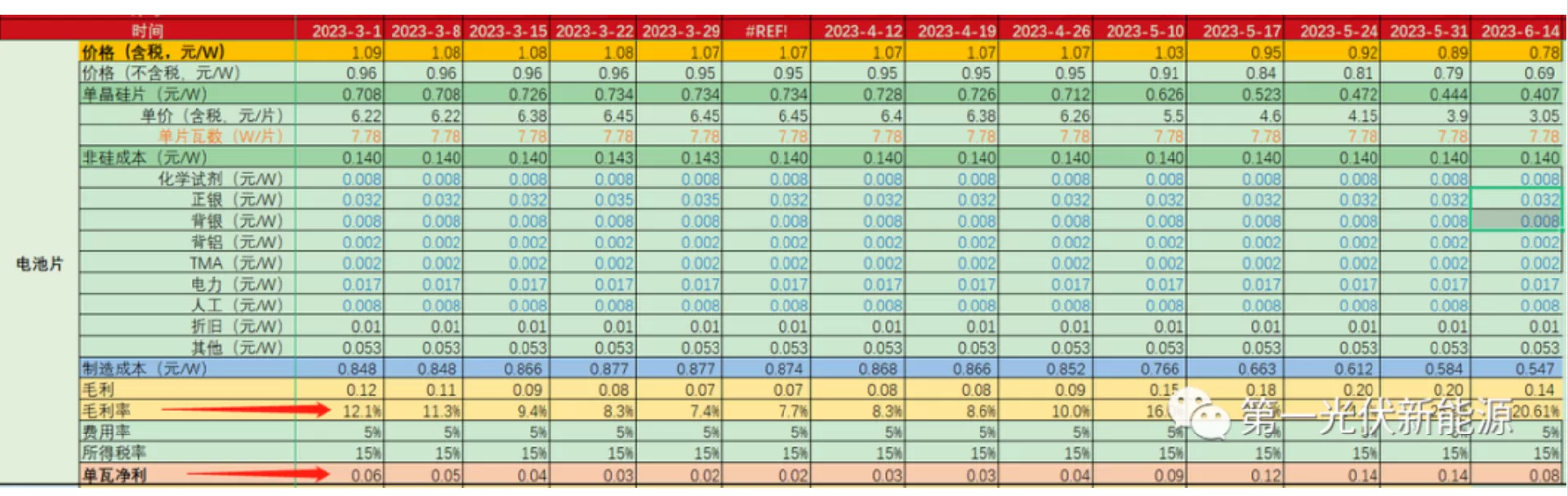

According to China PV network data, since March this year, the gross profit and net profit per watt of photovoltaic cells have fluctuated greatly (taking 182 PERC as an example), and the gross profit margin has dropped from 12% in early March to 7.4%, and then in the process of rapid decline in polysilicon prices, the gross profit of cells has risen rapidly and touched a high level of 25.9% at the end of May, as shown in the table below.

It can be seen that the price of upstream polysilicon has a fundamental impact on downstream cells. It should be noted that this table only counts the profit of cells corresponding to the wafer price pair during the same period. Considering the general inventory cycle of downstream cell companies of 1-2 months, the profit fluctuation of the corresponding cell will be delayed in the case of the first-in, first-out method of cost statistics.

Continuing to compare the fluctuations of wafer and cell prices during the same period, it can be found that there is a lag in the magnitude of the changes in cell prices compared with silicon wafers. Since entering June, the decline in cell prices has intensified, indicating that the transmission of polysilicon prices has begun to appear, resulting in a rapid decline in cell gross margin in mid-June.

(3) Improve efficiency

At present, the efficiency of N-type cells of various manufacturers is improving rapidly, and the mainstream efficiency is more than 25%, and it is expected that the efficiency will be further improved by introducing the SE platform, double-sided passivation and tandem cell technology breakthroughs in the future.

1. Reduce electrical losses

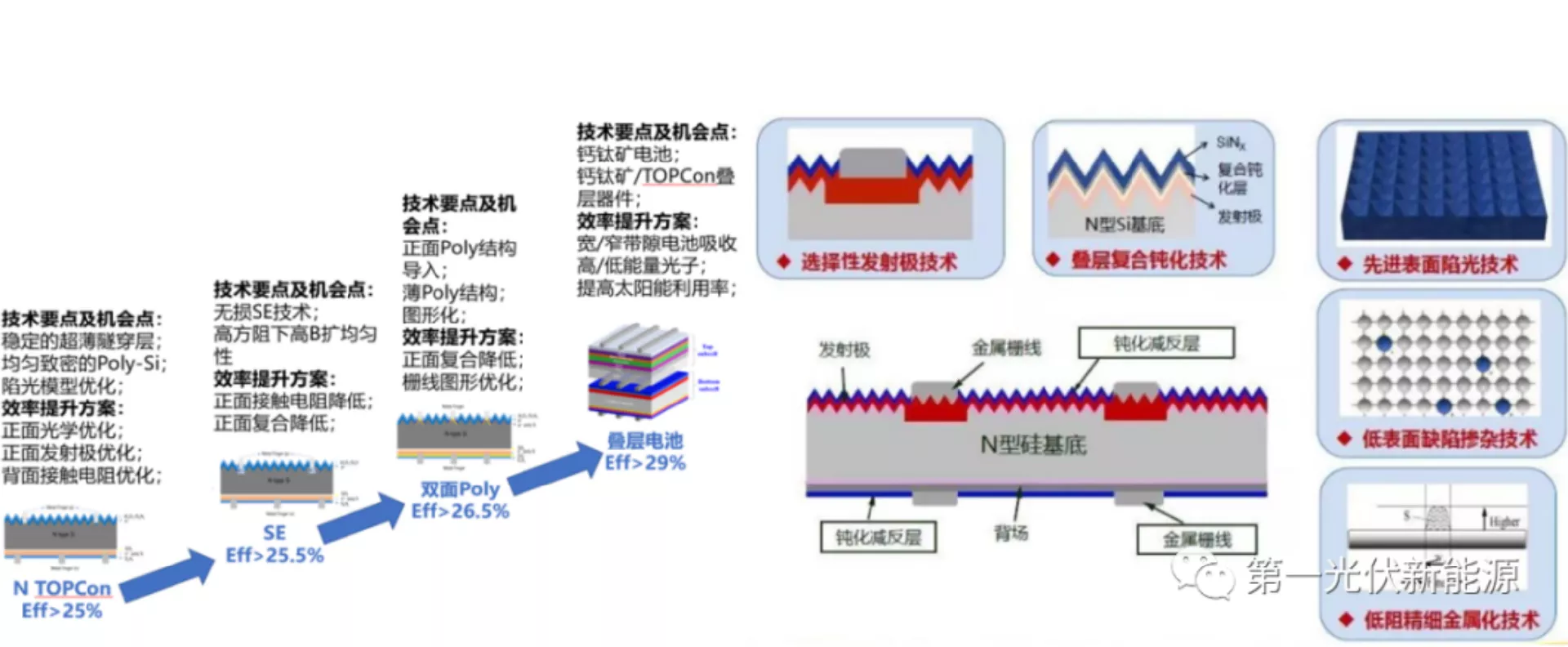

The core of TOPCon's efficiency improvement lies in reducing electrical losses, including SE, bifacial POLY, global passivation, and tandem cells.

TOPCon efficiency improvement requires reduced electrical losses. Manufacturers are about to introduce the SE platform, and some institutions expect that this will improve efficiency by 0.2%-0.4%; The introduction of double-sided PYL in 24 years is expected to increase the mass production efficiency to more than 26%; The introduction of global passivation technology in 25 years is expected to improve efficiency to 27%, and then the main line of efficiency improvement is the development of tandem cell technology.

At present, the efficiency of N-type cells of various manufacturers is improving rapidly, and the mass production efficiency of mainstream manufacturers is between 25% and 25.5%, and it is expected that the efficiency will be further improved by introducing the SE platform, double-sided passivation and breakthrough in tandem cell technology in the future.

2. Selective emitter

The SE technology in TOPCon is similar to the principle of SE in PERC, and high/low concentration doping inside and outside the electrode can improve the life of silicon wafer few births and improve cell efficiency. SE (Selective Emitter Technology) refers to the formation of a P++ layer by high-concentration doping at and near the contact site of the metal cathode and silicon wafer, and a low-concentration doping to form a P+ layer in the area outside the electrode.

This technology not only ensures a low contact resistance between the silicon wafer and the electrode, but also reduces the surface recombination rate of the silicon wafer to improve the low birthrate life of the silicon wafer, thereby improving the conversion efficiency of the cell. The boron doping process is more complex and the laser power is higher; There may be two types of passivation layer burning through the process, and the laser power needs to be accurately controlled.

The laser doping in TOPCon is divided into two paths: primary boron expansion and secondary boron expansion, and the mainstream of mass production chooses primary laser direct doping. A boron expansion is similar to the boron expansion process standard in the PERC production process, the process is relatively simple, only one laser doping, boron expansion and cleaning are carried out under this path, the process is simpler and the equipment investment is low, but the technical difficulty is higher.

3. DOUBLE-SIDED POLY

At present, the passivation structure is mainly used on the back surface of the battery, and the double-sided passivation/global passivation can further improve efficiency. At present, TOPCon batteries are only passivated on the rear surface, and the front surface still adopts the traditional battery structure. In order to further reduce the carrier recombination rate and reduce the contact resistance on the surface of the battery, P-poly can be performed under the front electrode, and the double-sided/global passivation structure can be used to further improve the frontal efficiency.

The silicon wafer matrix of the double-sided passivation contact cell is provided with a polysilicon layer on the front side, and the back side of the matrix is a P-doped poly passivation layer. Unlike double-sided passivation, which is only P-poly under the electrodes, global passivation technology is expected to further improve efficiency by P-poly the entire front of the battery.

5. Industry supply and demand

(1) Installation requirements

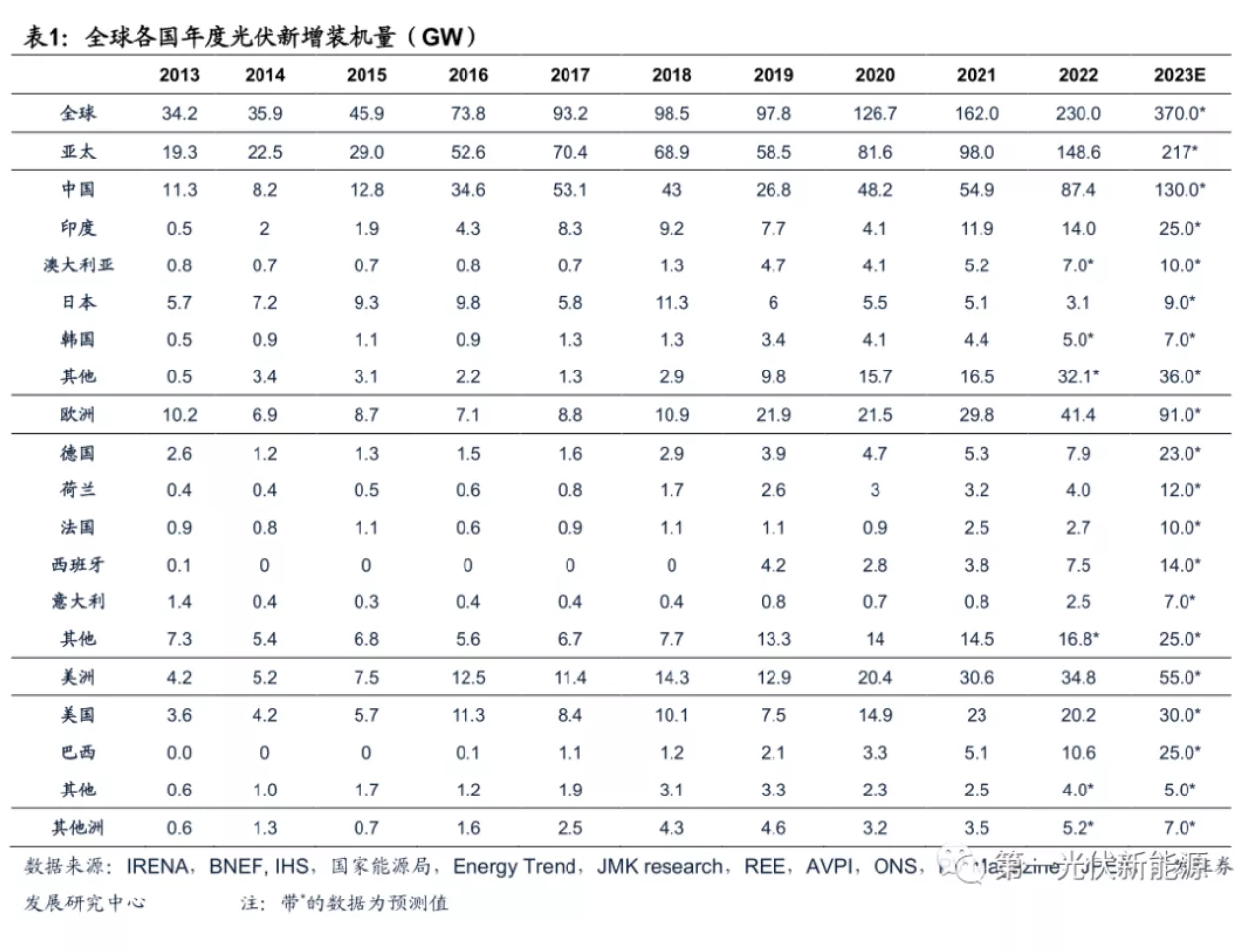

According to data from the China Photovoltaic Industry Association, in 2022, the total installed capacity of global photovoltaics will be about 230GW. According to the estimated data of GF Securities, the global installed capacity will be around 370GW in 2023.

(2) Production capacity

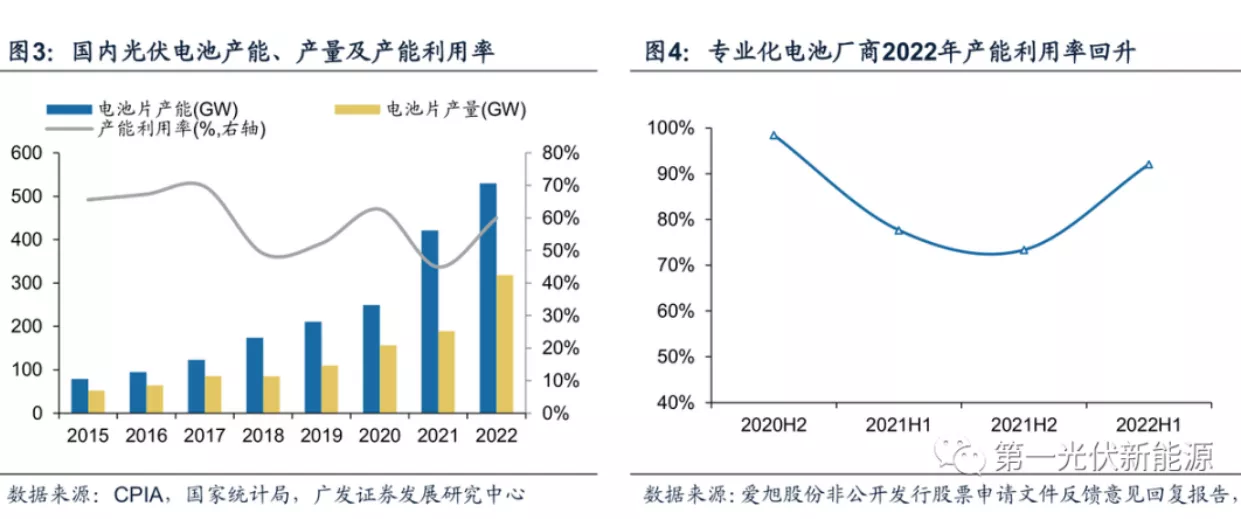

In terms of production capacity, since 2019, leading manufacturers such as Tongwei, LONGi, Jinko, AiXu, etc. have announced the expansion of high-efficiency monocrystalline cells, and carried out technical transformation and expansion for double-sided PERC and large-size cell technology, resulting in the growth rate of domestic cell production capacity much higher than the growth rate of production, and the capacity utilization rate has gradually declined.

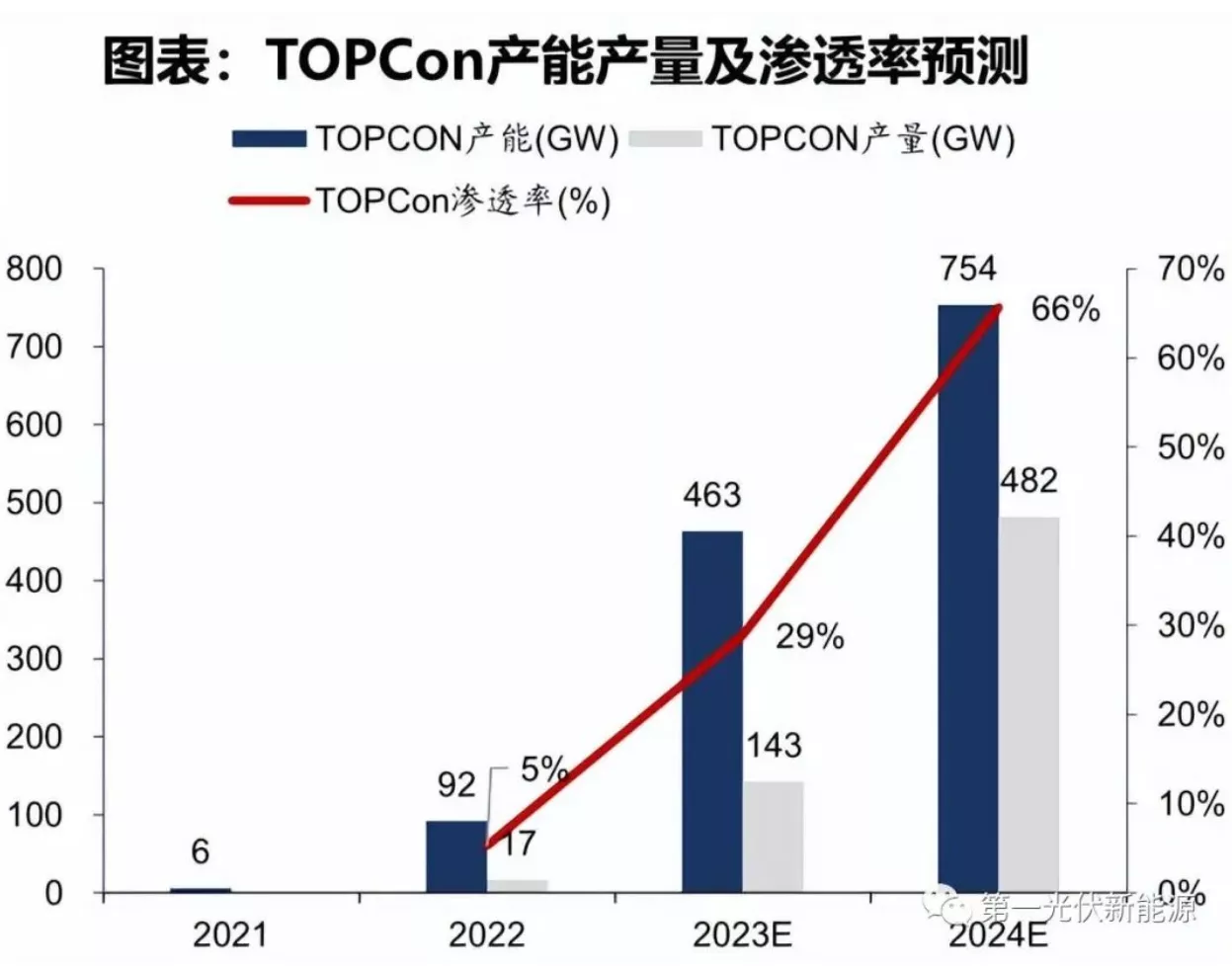

According to the statistics of Soochow Securities according to the announcements of various listed companies and non-public channel news, by the end of 2022, China's TOPcon production capacity is about 90GW, according to the current planned capacity statistics, it is expected that by 2023H2, TOPCON production capacity will be about 460GW, and 2024H2 production capacity will be about 750GW. It is not difficult to see that TOPCon will expand production significantly in 2023, industrialization will progress rapidly, and first-line manufacturers will lead the production capacity layout.

In terms of production, according to CPIA data, China's cell production has grown rapidly from 11GW in 2011 to 318GW in 2022, and TOPCON cell production in 2022 will be about 17GW.

As of 2022H2, China's TOPCON production capacity is 92GW, with an output of about 17GW and a penetration rate of about 5%; The market expects that by the end of 2024, China's TOPCON production capacity will be 754GW, with an output of about 482GW and a penetration rate of about 66%.

(3) Competitive landscape

From 2023, each manufacturer will significantly expand the production of TOPCon, according to the TOPCON photovoltaic cell production capacity plan announced by the company, the company can be roughly divided into three echelons:

The first echelon production capacity is planned to be greater than 60GW, which are Jinko, JA Solar, TRW, LONGi, Junda, and Tongwei, of which JA Power's 57GW, Trina Solar's 40GW, JinkoSolar 56GW and other TOPCon mass production lines are all scheduled to be put into operation in 2023;

The second echelon production capacity is planned to be about 10-25GW, which has a clear gap with the first echelon, and the main participants are Canadian Solar, Zhonglai, Yiyi, EGing, etc.;

The planned production capacity of the third echelon basically does not exceed 10GW, and there are many participants, and this part of the production capacity is about 232GW according to the statistics of Soochow Securities.

From the perspective of production progress, the expansion progress of TOPCon after first-tier manufacturers enter 2023 is generally significantly ahead of second-tier manufacturers, and the CR6 of the TOPCON industry is about 57.68%.

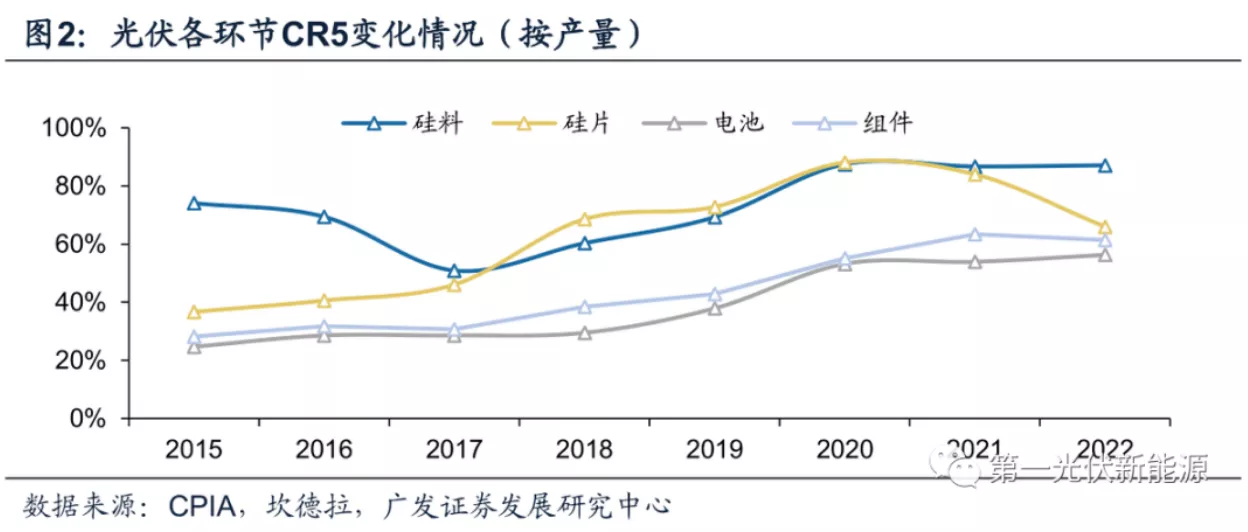

According to the statistics of the overall output of cells, CPIA data, the output proportion of China's top five photovoltaic cell manufacturers continued to increase from 29.5% in 2018 to 56.3% in 2022, and the industry concentration is still lower than that of other links in the photovoltaic industry chain.

In the field of full cells, the competition pattern of leading manufacturers is stable, Tongwei and AiXu are in the top two, and Jietai replaces Luan in the top five of the list.

In terms of cell efficiency, the average conversion efficiency of TOPCon mass production at this stage exceeds 25%, and the module power is evolving to high power, and the leading enterprises have a dynamic lead in technology.

It is worth noting that in May this year, Jolywood's POPAID technology pushed the efficiency value of TOPCON to a new height of 26.7%.

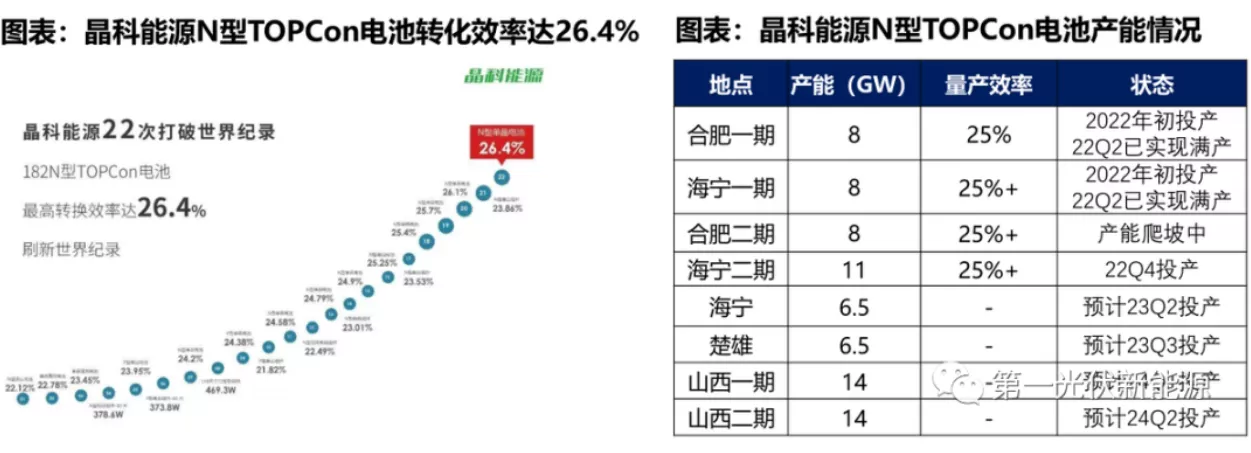

1. JinkoSolar

As of the end of 22, Jinko has 35GW of TOPCon cell production capacity, which is 8GW in Hefei Phase I, 8GW in Haining Phase I, 8GW in Hefei Phase II and 11GW in Haining Phase II. It is expected that by the end of 23/24, the production capacity is expected to reach 56/85GW, of which Haining 6.5GW and Chuxiong 6.5GW are expected to be put into operation in 23Q2 and 23Q3 respectively, and the first and second phases of Shanxi's 56GW integrated project will be put into operation in 24Q1-Q2. The company expects N-type shipments to account for more than 60% in 2023.

2. Junda shares

Junda's current N-type TOPCON has put into operation about 40.5GW and has a capacity of 13GW under construction.

3. Tongwei shares

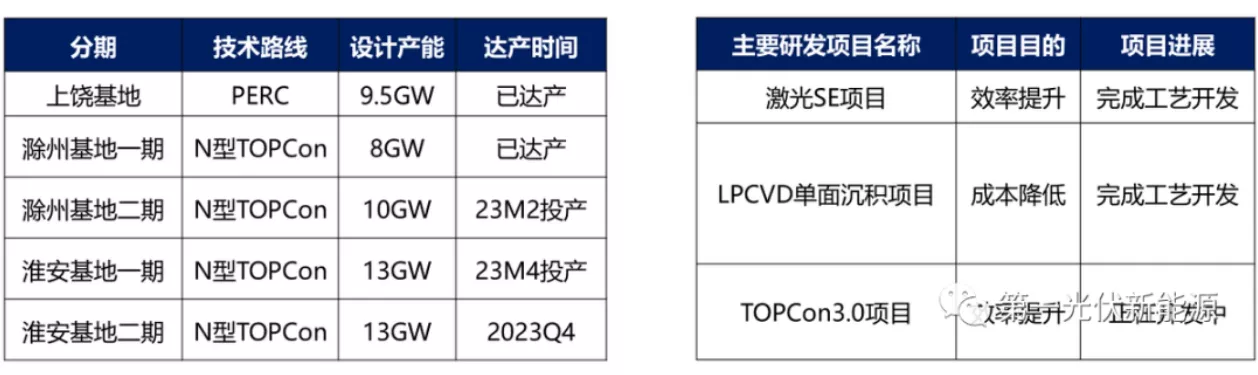

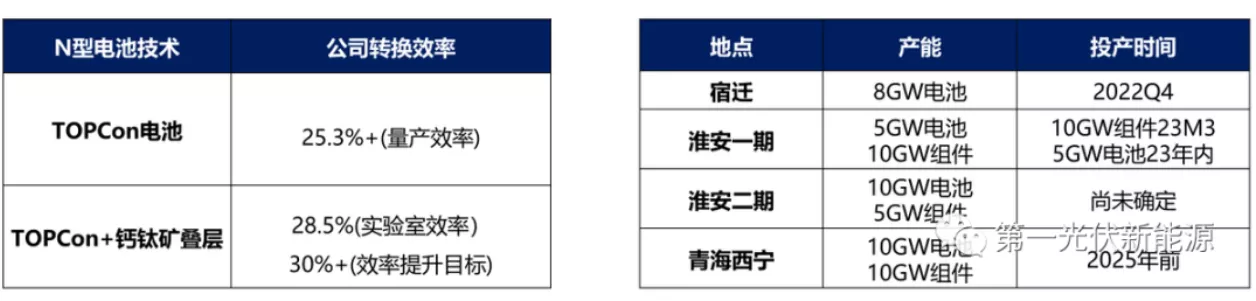

In terms of TOPCon production capacity, Tongwei has a 9.5GW topcon battery production capacity at the end of 22, and the 16GW TOPCon battery project in Pengshan Phase I has been launched at the end of 22, and it is expected to be released for the first time in July 23.

4. JA Technology

As of June 23, JA Solar has put into operation 7.3GW of TOPCon battery production capacity, of which 1.3GW of Ningjin has reached full production, and the cell mass production efficiency has reached 25.3%+. 20GW in Yangzhou and 10GW in Qujing will be put into operation in 23Q3. In May 23, the company launched the N-type new module DeepBlue 4.0Pro based on 182mm*199mm size rectangular silicon wafer, combined with high-density packaging technology, the maximum power of the 72 version can reach 630W, and the module efficiency exceeds 22.5%, which is equivalent to the power of the previous generation of 182 series 78 version modules of the same size, but the working voltage is 7.6% lower, which reduces the cost of system BOS and the risk of hot spots of the module.

JA expects wafer/cell/module production capacity to reach 70/70/80GW by the end of 23, and 80-90GW by the end of the year when the cell production schedule is smooth.

5. Trina Solar

At the end of 22, TRW's cell/module production capacity has reached 50/65GW, of which TOPCon production capacity is 8GW in Suqian, which is expected to reach full production in mid-2023, with a yield rate of more than 97%. In terms of new production capacity, TRW expects to start production of 30GW of new TOPCon cells in 2023, and the production capacity of TOPCon cells is expected to increase to 40GW by the end of 23.

6. LONGi Green Energy

Longji began the research and development of TOPCon technology in 2019, built a 500MW pilot line in 2021, and is expected to start production of 30GW in Ordos in August 2023, with a production capacity of more than 20GW by the end of the year, and is expected to achieve full production by 2024Q1.

(4) Premium comparison

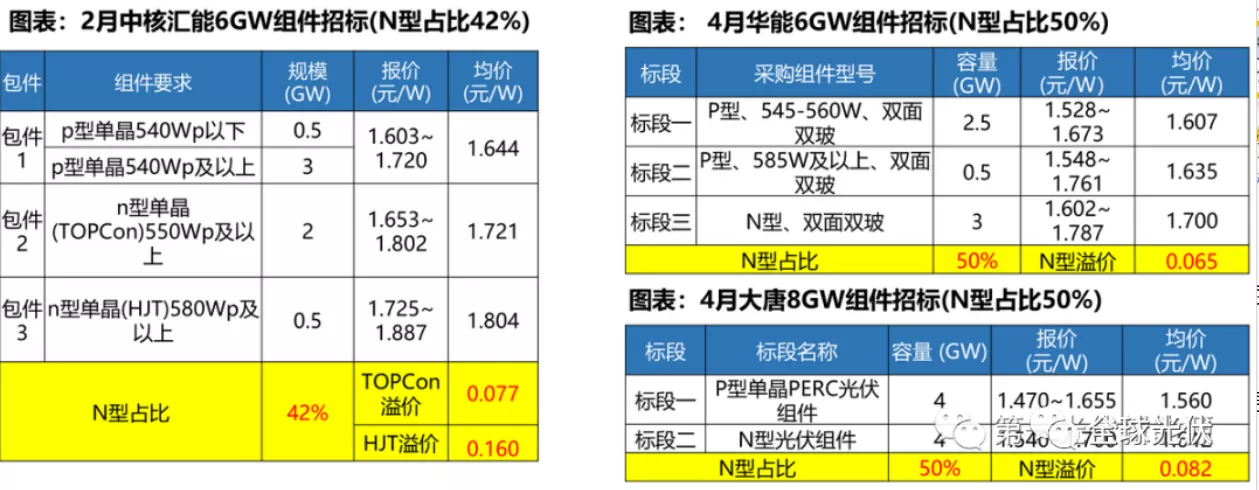

According to the seller's statistics, in the new module tender project, TOPCon products are favored for their high power generation gain, while enjoying a premium. The proportion of TOPCon components increased from 33% in February to 50% in April, and the share of TOPCon tenders continued to increase.

TOPCon accounted for 33% of the 6GW module tender of CNNC, and the quotation was about 8 cents/W premium to PERC. The TOPCon modules accounted for 50% of the bidding projects of Huaneng and Datang, and the quotations were 6.5 points/W and 8.2 points/W higher than the PERC modules, respectively.

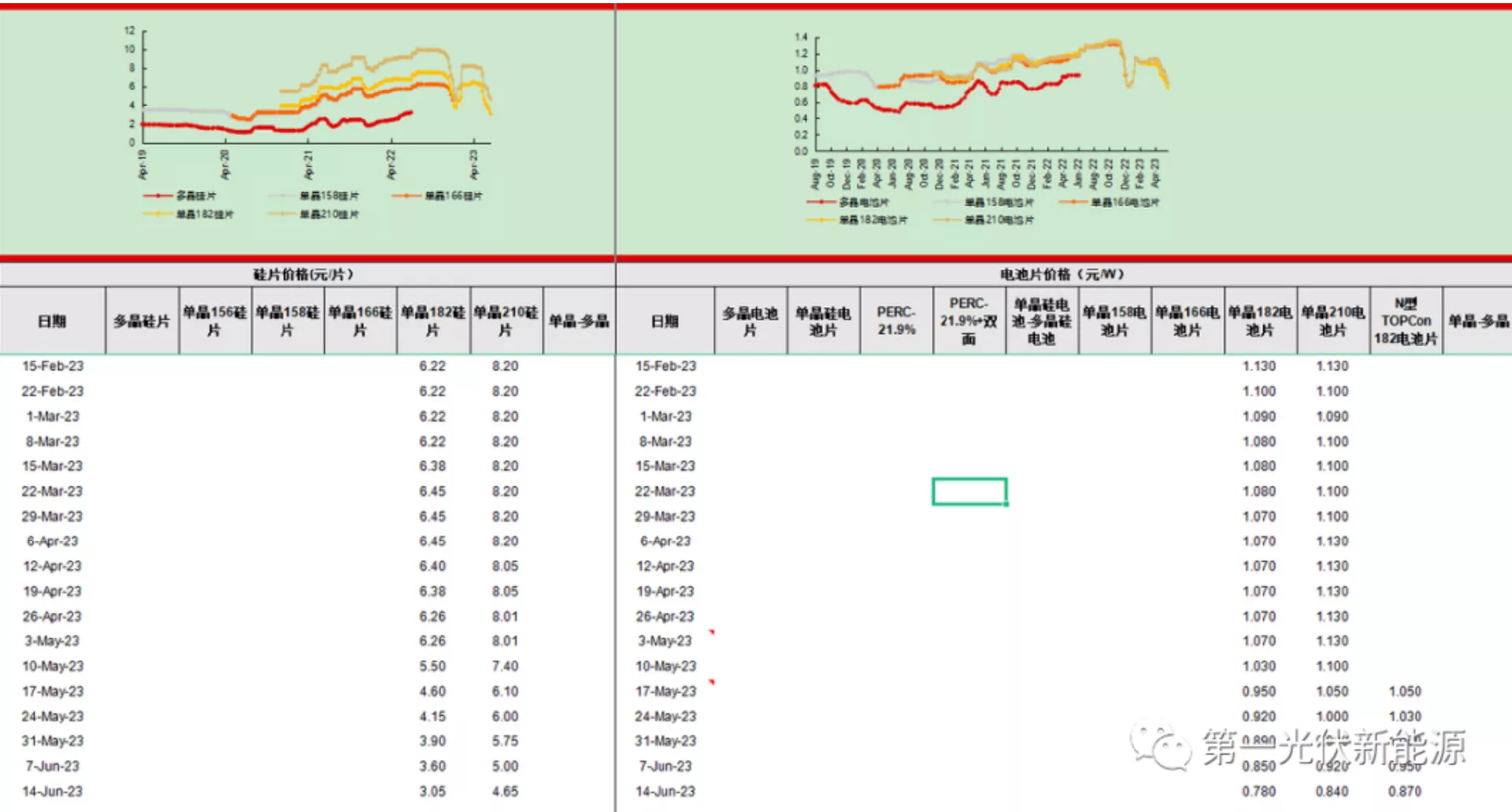

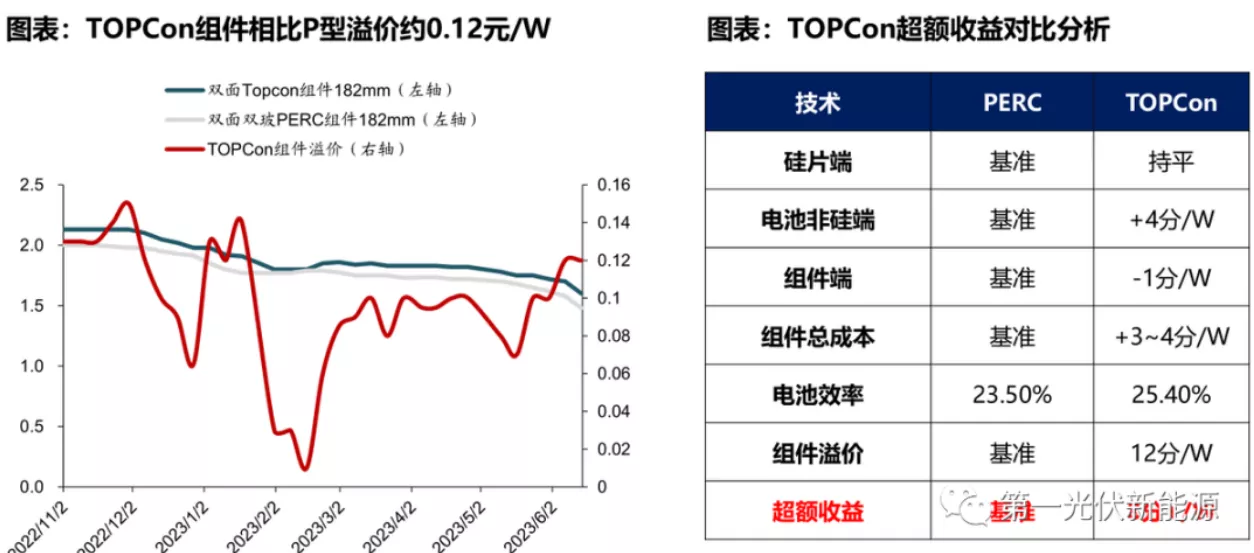

According to PVinfoLink's latest battery quotation on June 14, the price of 182 double-sided TOPCon battery is 0.87 yuan/W, and the price of PERC batteries of the same size is 0.78 yuan/W, with a premium of about 9 points/W; The average price of double-sided TOPCon modules (182mm) is 1.6 yuan/W, the average price of P-type is 1.48 yuan/W, and the N-type module is about 0.12 yuan/W premium to the PERC module, indicating that the power generation gain of N-type modules has been recognized by the terminal.

The total cost of TOPCon components is 0.03-0.04 yuan/W higher than that of PERC, and the overall TOPCon has achieved more than 8 points of excess income, highlighting the economy.

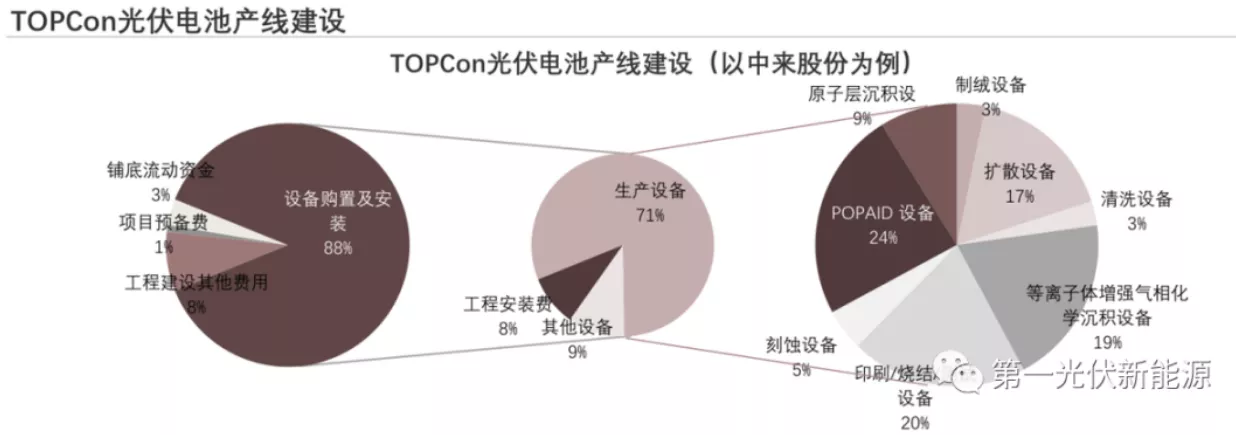

(5) Investment intensity

According to feedback from many parties, the cost of equipment for TOPcon's new production line is about 1.5-170 million yuan/GW. Among the initial investment costs of new production lines, equipment purchase and installation costs accounted for the highest proportion, followed by construction engineering costs, with an average overall construction cost of about 360 million yuan/GW.

Taking Jolywood's 16GW high-efficiency monocrystalline cell smart factory project (phase I) as an example, equipment purchase and installation accounted for the highest proportion of equipment purchase and installation in the construction cost of its TOPCON photovoltaic cell production line, about 88%, followed by construction costs, accounting for about 8%; The production equipment value is the highest in the TOPcon production line, accounting for about 71%, of which the POPAID equipment whose core process is used to deposit polysilicon thin films accounts for about 24% of Jolywood's shares.

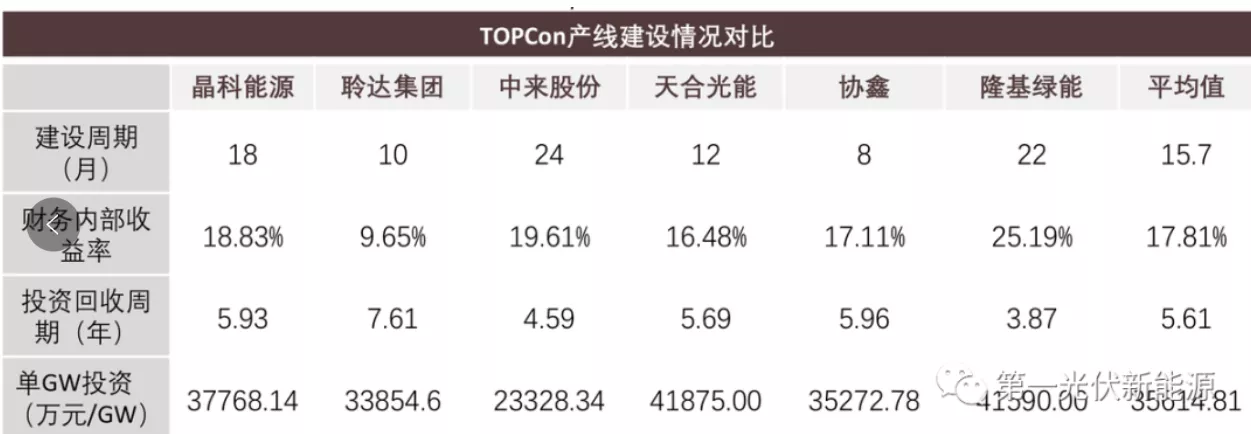

According to data released by Jinko, TRW, GCL and others, the average construction period of TOPCON production line is 15.7 months, the average payback period is 5.61 years, and the average initial investment cost per GW is about 360 million yuan.

6. Industrial synergy

(1) Silicon materials

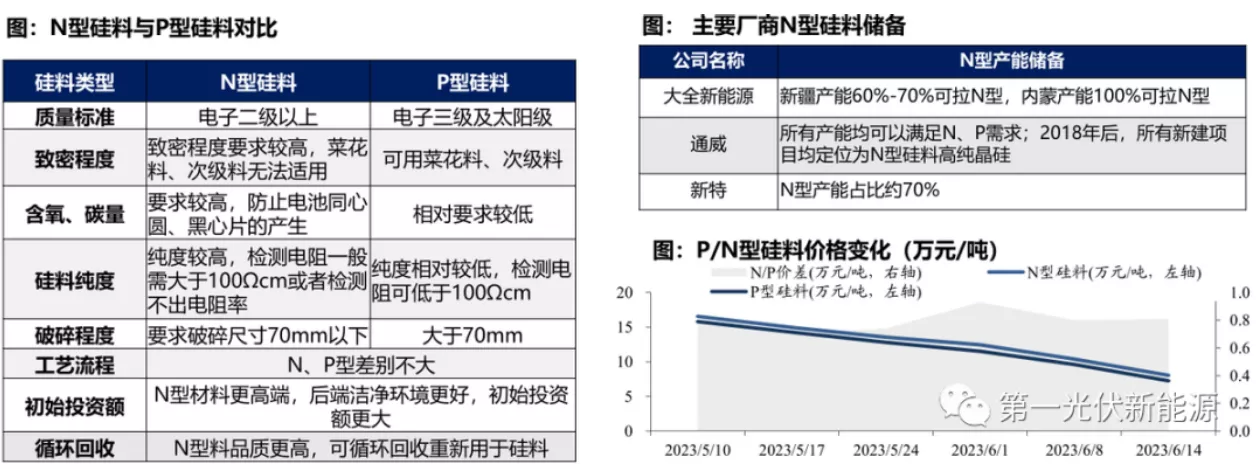

N-type products have high requirements for polysilicon quality, and at present, N-type polysilicon requirements reach electronic grade II or above, which is two grades higher than P-type materials, and the gap in technical indicators is 2-10 times. At present, the domestic Tongwei/Daqo/Xinte N-type material production capacity reserves are sufficient, and in the future, with the increasing demand for N-type, the N-type production capacity reserves of mainstream manufacturers are gradually released, and the domestic supply ratio is expected to increase accordingly.

According to the data of the silicon industry branch, the current N-type material compared with the P-type, the premium of 8,000 yuan / ton, in the future, with the acceleration of the wafer thinning process, the N-type silicon wafer competition is fierce, the demand for N-type material increases, the penetration rate is gradually increased, and the premium is expected to further expand.

(2) Silicon wafers

TOPCON uses N-type silicon wafers. N-type silicon wafers are doped with boron elements in the crystal pulling process, and phosphorus ions are diffused in the cell production process.

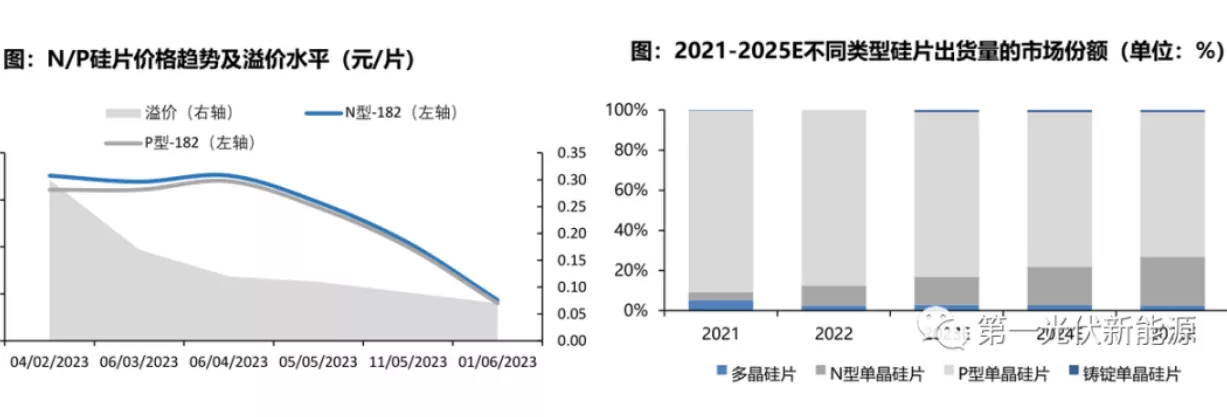

As of 23230531, N-type silicon wafers have a premium of about 7% over P-type. Because the process of N-type cells is more complex than that of P-type, their cost is also higher.

According to data from the China Photovoltaic Industry Association, the market share of P-type monocrystalline wafer shipments will reach 87.5% in 2022, and only 10% of N-type monocrystalline wafers, and we expect that the production of N-type monocrystalline wafers will account for 25% in 2025, which will increase rapidly.

Driven by cost reduction and efficiency improvement, mainstream manufacturers are constantly promoting the thinning process of silicon wafers, and their respective cell sizes are also different. At present, leading companies such as JA Solar, Jinko and Tongwei adopt rectangular silicon wafer technology, and silicon wafer manufacturers such as JA Solar/Jinko/Tongwei/TRW all adopt large sizes above 182mm, covering 182mm*182mm, 182mm*192mm, 182mm*199mm, etc.

(3) Silver paste

The front silver paste needs to achieve more functions and utility, and the technical requirements for the product are higher than those on the back silver paste, and its main function is to collect and derive photogenerated carriers. In order to ensure the photoelectric conversion efficiency of the cell, the front silver paste needs to have the basic requirements of good printing performance and high aspect ratio, and it needs to form good ohmic contact with the silicon wafer and reduce the contact resistance.

The silver paste on the back of TOPCON is not much different from the silver paste on the front side of PERC, but due to the need for frontal boron expansion emission stage in TOPCON, silver aluminum paste is required on the front side, so the value and consumption of TOPCON silver paste are higher than those of PERC.

As mentioned earlier, up to now, the average silver consumption of 182-size PERC batteries in the industry is about 60mg/piece, and the silver consumption on the back is about 20-30mg/piece, because the solid content of the back is 60%, which is converted to about 15mg/piece of positive silver, so the total silver consumption is 75mg/piece;

For 182-size TOPCon batteries, the silver consumption of the industry leader has been reduced to 47mg/piece on the front and 57mg/piece on the back, totaling about 104-105mg/piece;

HJT batteries are only 166 and 210 sizes, which translates to 182 sizes and the silver consumption is about 160-170mg/piece. Compared with the positive silver consumption of P-type batteries, the consumption of silver paste (positive silver + back silver) of TOPCon batteries is about 1.5 times on average.

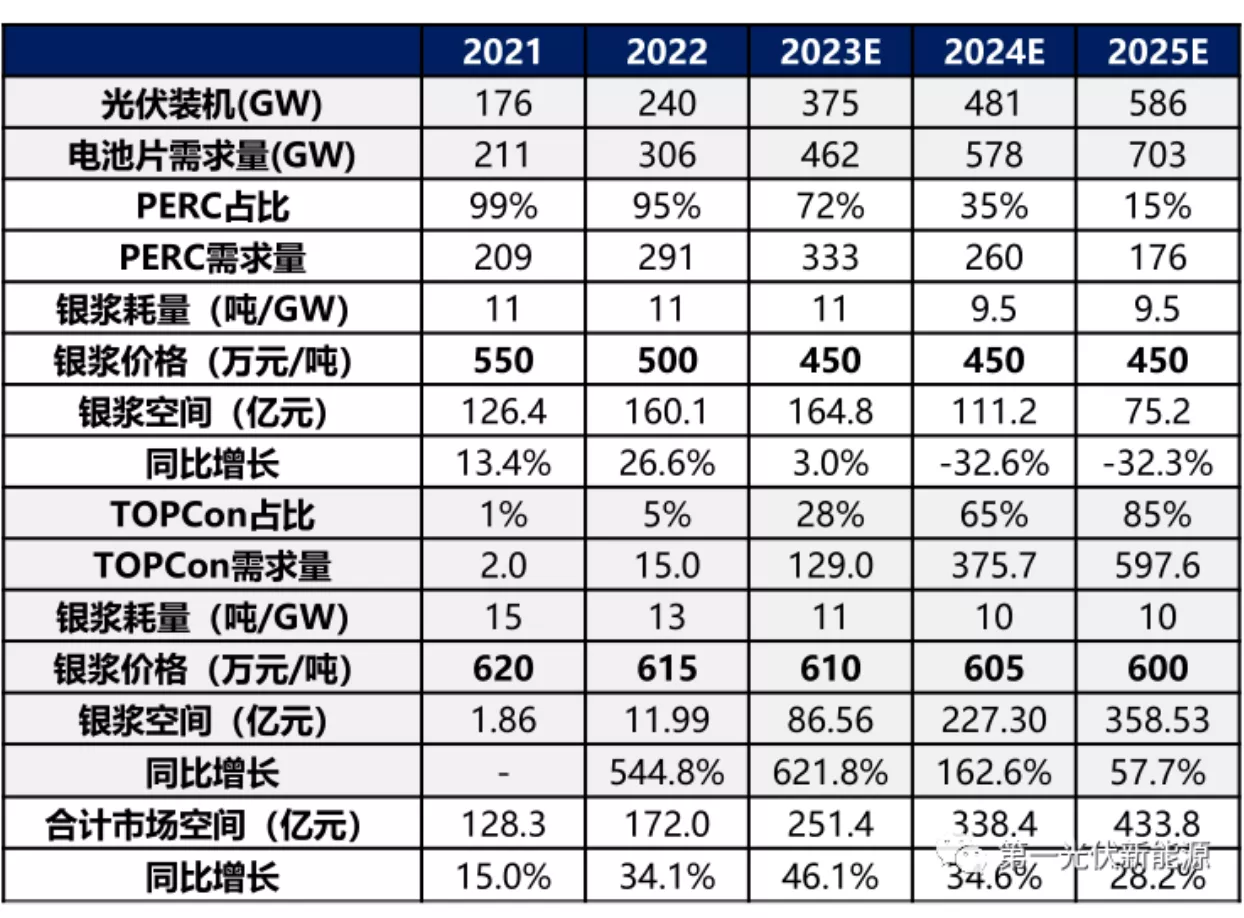

In terms of market demand for silver paste, some institutions expect that at the end of 23, China's PERC silver paste consumption will basically remain at 11 tons/GW, and this scale will drop to 9.5 tons/GW in 24-25 years; In 21-25 years, the consumption of TOPCon silver paste will be reduced from 15 tons/GW to 10 tons/GW, and the price of silver paste will maintain a slight downward trend, and it is expected that the total market space of silver paste in 23 years will be 25.1 billion yuan, and the market space will increase to 43.4 billion yuan by 2025.

In the past few years, with the continuous improvement of the technical content, product performance and stability of domestic positive silver paste, the degree of localization has continued to rise, and the localization rate has reached 75% in 22 years. Among mainland enterprises, Juhe Co., Ltd., Dike Co., Ltd., and Jingyin New Material (Suzhou Goodtech) occupy the main market share, with a market share of 41%/21% 13% in 2022, all of which have formed close cooperation with downstream head battery companies, and currently have reserves in TOPCon silver paste technology.

(4) Core equipment

TOPCON production equipment mainly involves four links: cleaning and texturing, boron diffusion, polysilicon thin film deposition and screen printing.

1. Wash the texturing

The cleaning process is relatively simple, the equipment complexity is low, and the domestic cleaning equipment can meet the needs of use. With the rapid expansion of TOPCON production capacity, the market demand for single-machine large production capacity and fully automated equipment will continue to increase; At present, the process stability of the single crystal texturing field has matured, and the single-machine production capacity is generally greater than 8000 pieces / hour.

The main enterprises of cleaning equipment are North Huachuang, Jiejia Weichuang, Shanghai Puchuan, etc.; The main manufacturers of texturing equipment are Jiejia Weichuang, North Huachuang and Suzhou Jujing.

2. Boron diffusion

The low-pressure diffusion equipment has the advantages of improving the uniformity and performance of square resistance, reducing inefficient pieces near intersections, reducing phosphorus sources and power consumption, achieving high square resistance (140-180Ω/cm2), and improving efficiency. Therefore, at present, the diffusion equipment is mainly low-pressure diffusion, and the new production line is mainly equipped with low-pressure diffusion + low-pressure oxidation equipment.

At present, the single-batch diffusion capacity of domestic diffusion furnaces has developed from 150 pieces to 2,000 pieces in 2022. At present, the main enterprises of diffusion furnace are Laplace, Jiejia Weichuang, Fengsheng Equipment, Hunan Red Sun, etc., at the same time, listed companies Dier Laser and Han's Laser have also begun to have the layout of related equipment.

3. Polysilicon thin film deposition

Compared with PERC, the biggest feature of TOPCON is that a tunneled oxide layer + doped polysilicon layer is prepared on the back. At present, there are two main technical routes in this link: LP and PE.

The main participating enterprises of LP equipment include Laplace, NAURA and Pule New Energy; PE equipment is mainly provided by Jiejia Weichuang, North Huachuang, Jinchen Co., Ltd. and Hunan Red Sun.

4. Screen printing

At present, the new production line mainly adopts high-precision alignment, large silicon wafer printing equipment, early screen printing equipment is mainly imported equipment, at present, domestic equipment basically occupies the new production line market and has been exported to India, Turkey and other emerging photovoltaic markets. The main equipment manufacturers in this field include: Maiwei Co., Ltd., Jiejia Weichuang Co., Ltd., Jinchen Co., Ltd., etc.

VII. Conclusion

At present, the field of photovoltaic cells is a fully competitive pattern, under the background of N-type replacing P-type, TOPCON currently has certain advantages in penetration, efficiency, industrial maturity, supporting collaboration, and P-type transformation. TOPcon head enterprises occupy the main market share, CR5 market share is basically about 50%, the industry scale effect is significant.

At the same time, integrated enterprises have a greater cost advantage than outsourcing companies in the cost of battery silicon wafers. On the other hand, due to the high proportion of silicon wafer cost to battery cost, integrated enterprises have a greater advantage in the cost side, taking 20230531 data as an example, the cost of integrated silicon wafers is 0.26 yuan/W, which is about 32% lower than the cost of 0.38 yuan/W of purchased silicon wafers.

The superposition of industry head effect and integration to reduce the cost of silicon wafers has led to new pure cell manufacturers facing various pressures such as process, efficiency, cost, and channels.

On the cell supply side, the current production capacity of the market can achieve market coverage for new installations, and the high initial investment cost and long payback period also need to be cautious for new entrants.

At present, in the photovoltaic industry, there is still a certain amount of domestic alternative space in the field of auxiliary materials, such as low-temperature silver paste and silver powder, POE particles at the module end, etc., it is recommended to pay attention to follow-up.

Source: First Photovoltaic New Energy

Editor: Wang Rui Review: Hao Yuzhu